…as Group Targets Expansion

By Yona Banda

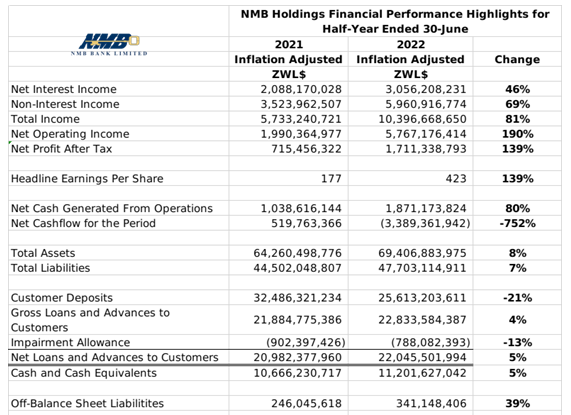

Financial Performance Highlights

- Listed banking group NMB Holdings posted a ZWL$1.7 billion net profit after tax for the half year period ended 30 June 2022. The outcome was a 139% rise in inflation adjusted terms from the 2021 comparative despite the group incurring monetary losses of ZWL$2.2 billion.

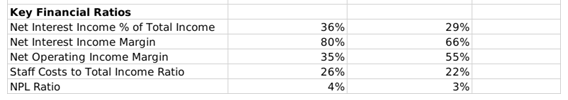

- The top line growth was supported by rising interest and non-interest income which hit ZWL$3.1 billion and ZWL$5.96 billion respectively. The non-interest income growth driven by digital banking fees of ZWL$2.5 billion, retail banking customer fees of ZWL$900 million and international banking commissions of ZWL$700 billion which was the fastest growing revenue segment. Fair value gains on investment properties also contributed ZWL$1.3 billion to non-interest income.

- Total income increased by 81% to ZWL$10.4 billion, while net operating income increased by 190% to ZWL$5.8 billion.

- The group’s customer deposits declined in inflation adjusted terms by 21% to ZWL$25.6 billion.

- The groups total assets stood at ZWL$69.4 billion, with cash and cash equivalents of ZWL$10.7 billion. Total liabilities stood at ZWL$47.7 billion, while off-balance sheet liabilities stood at ZWL$341 million.

- Inflation adjusted growth in the group’s gross loan was subdued at 5%. The group’s customer base is well diversified with private individuals, distribution, agriculture and services making up 18%, 26%, 22% and 21% respectively of the loan book. The group revealed that it expects to begin disbursing its EUR12.5 million European Investment Bank credit line to exporting customers in H2.

- The group declared an interim dividend of ZWLc 45 per share payable in cash or scrip.

- After meeting the minimum capital requirements, the group noted that it is currently in the process of expanding its group structure, with new subsidiaries being set up to complement its banking operations. The group expects to fund the expansions using internal resources and will not seek to raise capital from shareholders.

- The group expects to continue its digitization strategy, and is also looking to expand its agency banking networks in underserved markets. The latter is expected to compliment the Money Transfer Agency (MTA) business, which the group expects to bolster the group foreign currency earning capacity.

- In the boardroom, retiring directors Mr. C. Chikaura and Ms. S. Chitewe were replaced by Mrs. E. Chisango and Mr. D. Matenga.

Commentary and Analysis

On balance, it is a fair set of results from NMB Holdings. The group has been one of the more aggressive banks in digitizing its operations, and that seems to be paying off. The group is an interesting case study in the country’s financial services landscape. It occupies a relatively small space in the banking sector, positioned as an operation with a significant focus on SME banking and innovative digital banking solutions. With SME’s expected to drive the country’s economic development, and a growing tech-savvy youthful population, they seem like sensible anchors for the group. The question is if NMB Holdings can distinguish itself from the larger players to establish a dominant position in those customer segments – much like what Capitec managed to do in South Africa. Establishing that secure and resilient position could support the diversification into complimentary financial services where the larger banking groups already have a head start.

Looking at more immediate issues, the diversified exposure to the countries key economic sectors, and SME focus should be leveraged for more foreign currency credit lines with other development financing institutions. Given the group’s apparent “choice” to finance its expansion with internally generated resources, this will be critical to both its immediate and long-term prospects.

On the ZSE, the NMB Holdings share’s (NMB.zw) performance has been consistent with the other banking stocks. The share has outperformed the market since the start of 2022, with an 81% gain in nominal value and a 67% loss in implied USD value. It is currently trading at a Price to book ratio of 0.2x – Harare