By Yona Banda

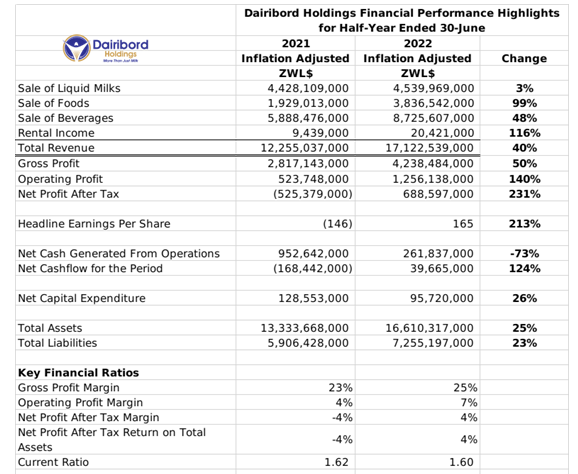

- Listed food and beverages manufacturer Dairibord Holdings earned a net profit after tax of ZWL$689 million in the financial half year ended 30 June 2022. The performance saw the group switch back to profitability from the comparative 2022 period.

- Total revenues rose by 40% in inflation adjusted terms to ZWL$17.1 billion. Beverage sales comprised the majority of the group’s revenue at ZWL$8.7 billion. Food product sales showed the highest inflation adjusted growth after doubling to ZWL$3.8 billion while growth in milk sales was subdued at 3% to ZWL$4.5 billion.

- Dairibord Holdings noted that raw milk intake by processors increased by 17% to 38.96 million liters in the first half of 2022. The group’s intake of 12.2 million liters represented 32% of the country’s milk production, which was a moderate decline but remained the largest among processors.

- Despite the declining intake, the group’s overall sales volumes gained 11% during the period to 47 million liters. The outcome was attributed to the groups product diversification strategy geared towards easing reliance on milk sales.

- Total assets stood at ZWL$16.6 billion and total liabilities reached ZWL$7.3 billion. The group noted that it had foreign currency obligations of US$4.6 million, but assured that most of the liabilities were covered by foreign currency denominated assets and expected disbursements from foreign exchange auction allotments.

- Going forward, the group highlighted its concerns about the country’s erratic power supply and high cost of borrowing. The group added that its main focuses will be increasing food and beverages sales, as well as cost containment. The volume growth is expected to be driven by the commissioning of new processing capacity and equipment in the third quarter. The group also said that it will realign its marketing channels to increase cash receipts, local USD and export sales.

- The group did not declare a dividend.

Commentary and Analysis

The financial performance aligns with the strategic priorities taken by the group’s management. The improving margins correspond with improved cost management despite the generally disruptive operating environment. Innscor’s integrated value chain approach means competitors in the fast moving consumer goods markets have to effectively manage their operating costs. Under the circumstances, it would have been assuring to hear that Dairibord had an initiative in place to lessen its reliance on the public electricity grid.

Beyond establishing sufficient capacity and efficient operations to meet its growth targets, the group will need to establish more direct linkages to the informal retail sector. It is particularly important because of the group’s foreign currency denominated obligations. From observation, Dairibord products are already fairly visible in informal retail “outlets”. Evidently, there is an appetite for the group’s products, and price competitiveness stands to benefit from more direct marketing channels to the informal operators. There seems to be a growing market for processed foods and beverages that incorporate indigenous foods in the informal retail sector particularly. Dairibord has already introduced a few products of that type, and it could be a boon if that emerging market can be cornered. Additionally, food and beverage products uniquely inspired by indigenous fruits/plants could be a more interesting proposition for export markets.

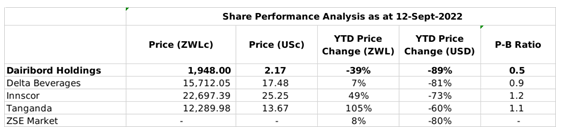

On the ZSE, the Dairibord Holdings share has been particularly hit by bearish market. Among a selection of other listed companies involved in the food and beverages sectors, the share is the worst performing. Since the start of 2022 the share has lost 39% value in nominal terms and 89% in implied US dollar terms. The share is currently trading at an estimated price to book ratio of 0.5x – Harare