By Yona Banda

Financial Performance Highlights

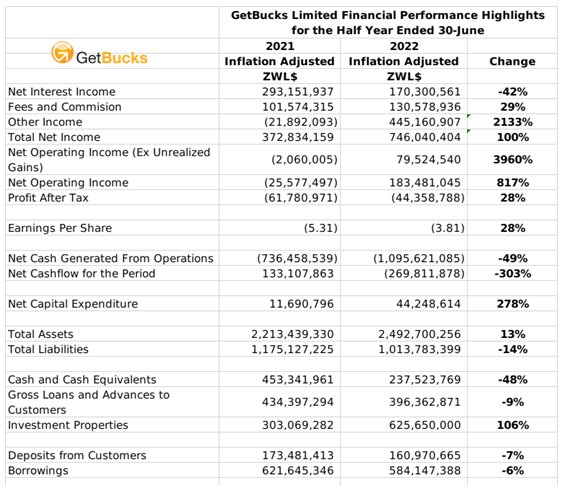

- Listed microfinance bank GetBucks Limited remain in the red an inflation adjusted after tax loss of ZWL$44.4 million for the half year period ended 30 June 2022.

- The company saw its total net income rise by 100% in inflation adjusted terms to ZWL$746 million. The growth was primarily driven by exchange gains of ZWL$103.7 million and fair value gains of ZWL$291 million.

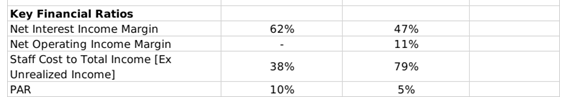

- Growth in operating income streams was subdued, with net interest income declining by 42% to ZWL$170 million while fees and commission rose by 29% to ZWL$130 million.

- The net operating income stood at ZWL$183 million, and ZWL$79 million excluding the exchange and fair value gains.

- The company’s operations generated a negative cash flow of ZWL$1.1 billion, and spent a net ZWL$44 million on capital investments.

- At the end of the period, total assets stood at ZWL$2.5 billion comprised primarily of PPE and Investment properties worth ZWL$1.7 billion, cash holdings of ZWL$238 million and the ZWL$396 gross loan book. The company attributed the 13% inflation adjusted growth in total assets to its diversified asset portfolio denominated in foreign currency.

- The company’s liabilities totaled ZWL$1 billion, with customer deposits of ZWL$161 million and borrowings of ZWL$584 million. Commenting on the 7% inflation adjusted decline in customer deposits, the company called it a reflection of ongoing ZWL liquidity constraints and RBZ auction settlement delays that prompted clients to withdraw their transitory deposits.

- Going forward, the company expects to expand its USD lending, and has attained credit lines to support the strategy. The company is also aims to invest in technology to increase its transactional revenues.

- The company did not declare a dividend as its aims to reach the minimum regulatory capital requirement. At the reporting date, the company’s core capital stood at ZWL$332 million (US$1 million), which falls short of the US$5 million required by the RBZ. The company is in the process of completing a capital raise that will see it become complaint with the minimum capital requirement.

- In the boardroom, Mr.P. Mutate resigned as a non-executive director effective 31 July 2022.

Commentary and Analysis

GetBucks is another interesting case in the landscape of Zimbabwe’s capital markets. Looking back, there is a sense that the company set out with lofty goals in an era when “tech disruption” was becoming the hot topic in the world of commerce. Indeed, GetBucks was part of an ambitious venture launched 2011 as MyBucks S.A which sought to create a Pan-African tech-driven financial services giant. The venture largely failed to hit the expected heights, and by 2020 mounting debts forced it to start divesting from several of its initial operations – although it maintained its 52% holding in GetBucks Zimbabwe. In December 2021 MyBucks SA was placed under bankruptcy and receivership in Luxembourg, where the company is registered. Parallel to that, Afristrat Limited (formerly Ecsponent Limited) – a JSE listed investment holding which owns 42% of MyBucks S.A initiated 5 forensic accounting investigations into the investee company. According to a cautionary statement issued by Afristat on the 12th of May 2022, the investigations found that the company had lost R1.5 billion in investments made into MyBucks S.A and its subsidiaries. The investments were made with the intention to grow the MyBucks SA loan book but were diverted to meet overheads and cover interest costs. As a consequence, the Afristat board has instructed its lawyers to pursue R250 million in civil claims against former responsible executives in MyBucks S.A and the company itself. Afristat has also filed an R800 million claim against MyBucks S.A with the company’s receiver in Luxembourg.

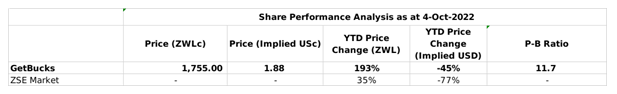

As noted previously, Afristrat owns 42% of MyBucks S.A, which in turn owns 52% of GetBucks Zimbabwe. Additionally, the company has an additional 32% direct shareholding in GetBucks as well as another 4.3% through its MHMK subsidiary. The implication is that the onus is on Afristrat to save GetBucks Zimbabwe with a much-needed capital injection. The problem however, is that Afristrat is going through a fair bit of financial trouble itself which has seen it fail to make preference share coupon payments and accumulate R25 million in outstanding obligations – some of which have drawn litigation. The company has proposed to restructure its debts by offering its R571 million worth of outstanding preference shareholders the chance to convert their investments to ordinary shares. In addition, the company also plans to raise R60 million of capital from its shareholders to ease the liquidity challenges. Of that R60 million, only R20 million has been earmarked for investment into the company’s underlying assets. At the moment, that R20 million roughly translates to US$1 million, versus the GetBucks Zimbabwe’s US$4 million minimum capitalization gap. GetBucks first issued a cautionary about the capital raise on the 18th of January 2022, which vaguely stated that negotiations where ongoing for a capital raise that could materially affect the share price if successful. There has not been any updates since, apart from an August 9th article reporting that the company was considering migrating to the VFEX as part of the capital raising efforts – which sounds a bit dire. As of the the 4th of October 2022, GetBucks had a USD implied market value of US$22 million versus a net asset value of US$1.9 million. Considering that listed banks are trading at price to book ratios ranging from 0.2x to 2x, GetBucks’ market valuation is eye catching.

All in, it will be interesting to see how the situation evolves. It looks likely that Afristrat will have to at the very least cede a significant part of its ownership to a strategic partner that can inject the necessary capital. However, valuation and legal issues surrounding MyBucks S.A stand to be complicating factors. There’s also the small issue of Zimbabwe’s terminally unstable economy. That said, at the right price, it could be a decent starting point for a forward-looking investor willing to have another go at tech disruption in the local financial services sector.

On the ZSE, since the start of 2022, the GetBucks share has gained 193% value in nominal terms and lost 45% in implied USD terms. It is currently trading at a P-B ratio of 11.7x – Harare