By Yona Banda

Financial Performance Highlights

- Hospitality group Rainbow Tourism Group (RTG) Limited saw its after tax profits surge to ZWL$1.3 billion in inflation adjusted terms for the half year ended 30 June 2022. The group’s Earnings Before Interest Tax Dividends and Amortization (EBITDA) climbed 300% to ZWL$1.9 billion.

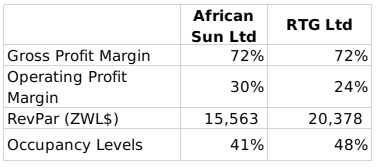

- The performance was supported by a 246% rise in the group’s revenues, which reached ZWL$7.1 billion. This was attributable to a 100% rise in occupancies to 48% and a 252% rise in revenue per available room to ZWL$20,378.

- The group’s operations generated a net cash flow of ZWL$1.3 billion, of which a net of ZWL$440 million was invested in capital, and ZWL$519 million was spent on lease principal repayments.

- During the period total assets increased to ZWL$16.6 billion and total liabilities declined marginally to ZWL$3.6 billion. The group had cash holdings of ZWL$326.8 million against zero interest bearing borrowings.

- Looking ahead, the group will aim to safeguard its profit margins through costs containment. The group will also pursue synergies with business partners, and product and market development projects. In the boardroom, Chairman Mr. A. Manase stepped down effective 22 July 2022 and was replaced by Mr. D. Hoto. Further, Mr. L. Mabhanga was co-opted to the board effective 24 March 2022.

- The group declared an interim dividend of ZWL$380 million of which a portion equivalent to US$250,000 will be payable in foreign currency.

Commentary and Analysis

The group’s financial performance generally lines up with industry peer African Sun Limited. The contrast is in the outlook, where RTG’s lesser internal resources have necessitated a more defensive forward strategy. The group’s operations also appear to have a heavier emphasis on domestic “business tourism” and conferencing activities – which bodes well as economic activity ramps up in the post COVID-19 environment. However, a concern will be developments that might negatively affect economic and socio-political stability in the country. Otherwise, with an absence of any foreign currency debts and the sufficient capacity to cover existing liabilities the group is in stable financial standing.

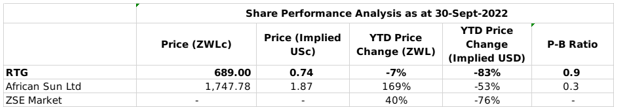

Since the start of 2022, the RTG share has lost 7% value in nominal terms and 83% in implied USD terms. The share is currently trading at a price to book ratio of 0.9x, which is significantly higher than industry peer African Sun Ltd – Harare