By ETimes

Mid-Term Monetary Policy Statement

General Updates

- Annual inflation declined to 101.3% in July 2023 after rising sharply to 175.8% in June 2023,

- The external sector position remains favourable and the country is expected to register a current account surplus for the fifth consecutive year since 2019. As at 30 June 2023 half-year forex receipts stood at US$5.6 billion (US$5.4 billion in 2022), payments and stood at US$4.4 billion (US$3.8 billion in 2022) and diaspora remittances at US$919 million (US$797 million in 2023).

Liquidity Updates

- The tight monetary policy stance saw the Bank issue Non-Negotiable Certificates of Deposit (NNCDs) worth ZWL$163.5 billion as of 14 July 2023. The Bank expects to strengthen NNCD operations to mop up excess liquidity.

- The cumulative value issued of Gold Coins and Gold Backed Digital Tokens (GBDT) stood ZWL$97 billion as at 30 June 2030.

- Statutory reserve balances increased from ZW$109 billion on 1 June 2023 to ZW$197.28 billion as of 14 July 2023. This is partly due to the policy change as well as an increase in the proportion of USD deposits to 80% from 64%.

- Broad money (M3) amounted to ZWL$14,275.48 billion as at the end of June 2023, compared to ZWL$2,338.23 billion in December 2022. On an annual basis, broad money grew by 1,174.94% in June 2023, largely reflecting exchange rate movements.

Foreign Exchange Updates

- During the first seven months of 2023, the Bank allotted a total of US$382.93 million through the Retail Auction System. Since inception of the Auction System in June 2020, a total of US$4.09 billion has been allotted, representing 85% of the total bids submitted.

- Cumulative purchases and sales on the Willing-buyer Willing- seller market in 2023 were US$112.57 million and US$107.19 million, respectively. From 2 January 2023 to 30 June 2023 a cumulative total of US$10.5 million was traded through the Bureaux de Change.

Banking Sector Updates

- As at 30 June 2023, the banking sector was adequately capitalized and all banking institutions were in compliance with the prescribed minimum capital adequacy ratios. Total banking sector assets increased from ZWL$3.81 trillion as at 31 December 2022 to $27.28 trillion as at 30 June 2023.

- Aggregate banking sector loans and advances increased by 7.9 times from $1.29 trillion as at 31 December 2022 to $10.19 trillion as at 30 June 2023. This was largely attributable to an increase in foreign currency-denominated loans, which constituted 94% of the sector’s loan book.

- The aggregate non-performing ratio (NPL) rose to 3.62% as at 30 June 2023 from 1.58% as at 31 December 2022 largely due to revaluation effects on foreign currency denominated non-performing loans.

- During the six months to June 2023, a total of 376.6 million transactions valued at ZWL$83.6 trillion were processed through the national payment system. Over the same period aggregate digital payments transaction values increased by an average of 40%, whilst volumes fell by 4%

Key Policy Updates

- Minimum lending and deposit rates will remain at current levels.

- Statutory reserve levels will remain at current levels.

- The Bank will continue to utilize Open Market Operations (OMO) that include NNCDs, gold coins, GBDT and the wholesale auction system to stabilize the exchange rate.

- The Bank is working towards implementing a transactional phase for the GBDT. It is expected to allow the public to use GBDT in day to day transacting as a complement for USD and ZWL.

- On the back of the stabilizing effects of its tight monetary policy, and the RBZ is expecting monthly inflation to fall to levels of less than 3% over the rest of the year.Consequently, annual inflation to fall to between 60% and 70% by the year.

Mid-Year Budget Review

General Updates

- Economic growth is now projected at 5.3% in 2023. ZIMSTAT estimates economic growth during the first quarter of 2023 at 6.2% and 6.5% for the year 2022.

- The revised growth projection is on account of strong performance in agriculture, ICT, accommodation and food services, as well as substantial improvements in the electricity supply situation.

- The agriculture sector, initially projected to grow by 4% in 2023, is now projected to grow by 9.7%. The total cereal production, excluding the winter wheat crop, is estimated at 2.6 million tonnes for 2023, a 40% above the production levels achieved last year.

- Growth in the mining sector during 2023 is now projected at 4.8%, due to increases in the production of lithium, chrome, diamonds and PGMs.

Fiscal Outturn

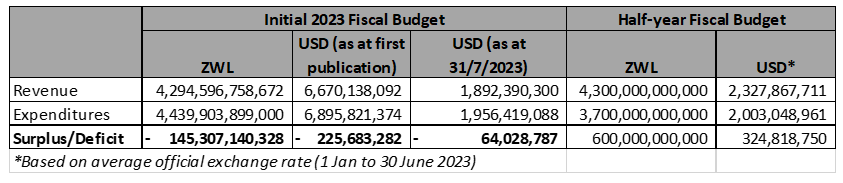

- Preliminary cumulative revenue collections from January to June 2023 amounted to ZWL$4.3 trillion, against expenditures of ZWL$3.7 trillion, resulting in a budget surplus of ZWL$608.5 billion.

- Government disbursed ZWL$48.2 billion for social protection programmes during the first half of the year, resources amounting to ZWL$248.2 billion were channeled towards health, ZWL$511.9 billion was disbursed towards education, and a total of ZWL$478 billion was availed for infrastructure.

- Development Partners disbursed resources amounting to US$151.9 million which went towards the following sectors, among others, health (60%), humanitarian assistance (14.8%); agriculture (10%); governance (8.3%) and education (3.2%).

Key Policy Updates

According to the Treasury, focus will be on consolidating the stability achieved so far by maintaining tight fiscal policies, while implementing measures to restore aggregate demand.

Commentary and Analysis

Evidently, from the lack of any significant policy changes, the government appears set on keeping the ship steady and maintaining course. A major take from the RBZ’s monetary updates appears to be that the wider economy has largely dollarized at this stage. The overarching policy emphasis seems to be on maintaining stability by controlling the velocity of the ZWL through the high interest rate regime and liquidity mopping operations. The reported fiscal outturn figures are indicative of the inflationary environment, with the nominal half-year figures more or less equal to the initial full year budget projections. Rough analysis suggests that the half-year expenditure fell significantly below initial targets in real terms. The sustainability of this apparent expenditure containment will be of interest as the year progresses – ideally, the savings are not a result of deferred local currency payments to government suppliers. Otherwise, there is a bit of a precariousness about the stability being touted, and it will be interesting to see if it will sustain for long enough to see tangible signs of economic relief – Harare

Advertisement