By ETimes

Financial Performance Highlights

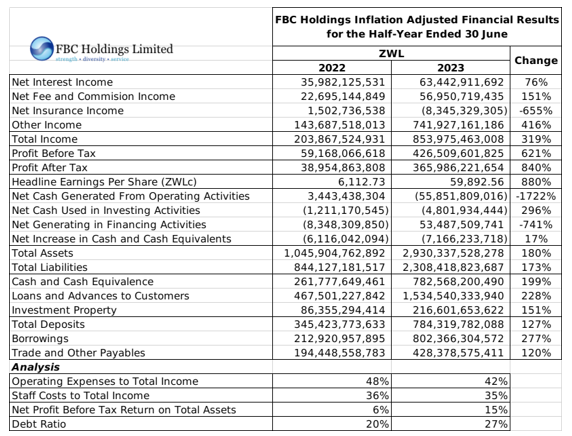

- ZSE listed FBC Holdings announced a ZWL$365.99 billion net profit after tax for its half-year ended 30 June 2023, an 840% increase from the 2022 comparative.

- The performance was supported by a 516% rise in net foreign currency trading and dealing income, which reached ZWL$515.2 billion. Fair value adjustments to the group’s investment properties contributed ZWL$124.8 billion. This saw the group’s total income surge 319% to ZWL$854 billion.

- Growth in the group’s core revenue was comparatively subdued, with net interest income rising by 76% to ZWL$63.4 billion, net fees and commissions rising by 151% to ZWL$56.96 billion and net insurance income falling by 655% to a loss of ZWL$8.3 billion.

- The group’s operations generated a negative cash flow of ZWL$55.8 billion, and supplementary financing was raised to cover the deficit.

- The group noted that the majority of its transactions are denominated in foreign currency, and estimated that over 80% of its assets and core revenues are in foreign currency.

- Total assets increased by 180% to ZWL$2.9 trillion, with cash holdings making up ZWL$782.6 billion and customer loans and advances ZWL$1.5 trillion. Total shareholder equity increased by 208% to ZWL$621.9 billion.

- Total liabilities stood at ZWL$2.3 trillion, with deposits contributing ZWL$784 billion and borrowings of ZWL$802 billion.

- Total deposits increased by 127%, but the sector composition remained relatively stable with the public sector (15%), manufacturing (8%) and financial services (45%) the largest contributors

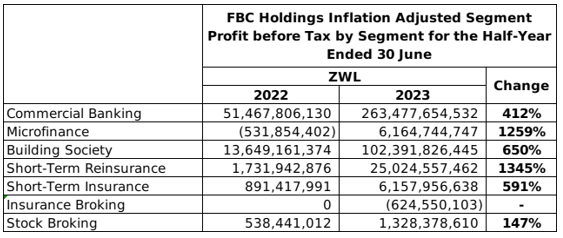

- Most of the group’s segments experienced significant growth in before tax profits. The commercial banking and building society units remained the primary profit centers. The microfinance unit rebounded to profitability while the short-term reinsurance unit showed the highest profit growth.

- The group reported increased demand for residential property in both rental and purchase segments as companies seek to migrate from the CBD. The group also reported the completion of 98 units under the Zvishavane Eastlea project, with 13 housing units under construction in the Glen Lorne suburb. The group also currently holds 267 housing units under the Kuwadzana Fontaine Ridge housing project.

- The groups have reached an agreement to acquire Standard Chartered Bank Zimbabwe and its associated interests. The transaction is subject to regulatory approval, with the group aiming for completion before the end of 2023.

- Mrs. A. Shumba was appointed the Managing Director of FBC Insurance effective 1 September 2023 following the passing of her predecessor Mr. M. Bako.

- The group reported that all of its subsidiaries were compliant with their regulatory minimum capital thresholds.

- Going forward, the group expressed optimism about the inflation stabilization policies implemented by the government, and will focus on capital preservation and growth strategies to sustain shareholder value.

- The board declared an interim dividend of USD0.45 cents per share payable at the end of September 2023.

Commentary and Analysis

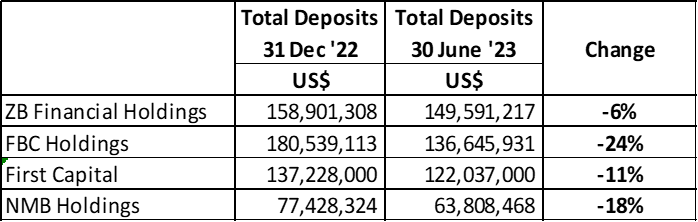

Once again, it is becoming increasingly difficult to make anything of ZWL denominated financial statements. The most noticeable thing here is the significant share of exchange rate related unrealized gains in the groups income mix. The relatively subdued growth in the groups more conventional revenue streams is also noticeable. The group’s core income increased by 98% compared to growth in operating expenses of 265%. Consequently, the groups opex to core income ratio worsened from 165% to 304%. The other noticeable thing is the decline in the group’s deposits in real terms. The size of the decline being larger than peer banking groups is also a concern. All this suggests that growth in the group’s underlying business is not meeting expectations – and there has been a concerted effort to firmly establish FBC as one of the big boys in Zimbabwe’s financial services sector. So, there is a big spotlight on the group’s impending acquisition of Standard Chartered Zimbabwe. In the wake of CBZ’s acquisition of the ZB and FMH groups, this transaction reads a bit like a reactionary defensive move. It is hard to argue the strategic value of the acquisition considering that a large part of the customer appeal of Standard Chartered is probably in its status as a foreign controlled entity that is part of a reputable international banking group. Time will tell, but there may have been other avenues for the group to pursue growth.

The FBC Holdings share has outperformed its industry peers with a nominal return of 1,206% and an implied real return of 93%. The share is trading at a Price to Book ratio of 1.08x which is the highest among its peers – Harare

Advertisement