…as Sales Volumes Decline 6%

By Yona Banda

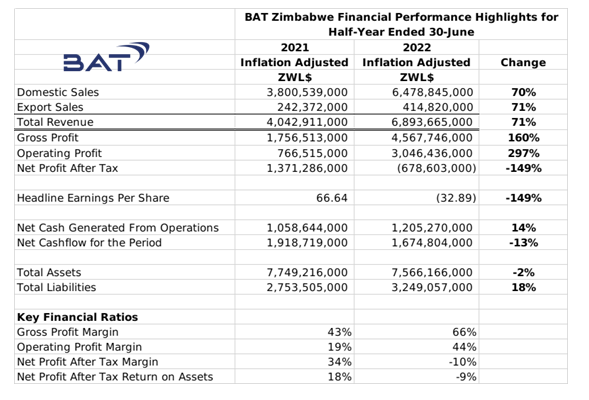

Financial Performance Highlights

- Listed cigarette manufacturer BAT Zimbabwe earned an inflation adjusted after tax loss of ZWL$678 million. The loss was largely a reflection of hyperinflation related monetary losses incurred during the period of ZWL$2.2 billion.

- Total revenues increased by 71% in inflation adjusted terms to ZWL$6.9 billion, comprised of domestic cigarette sales of ZWL$6.5 billion and cut rag export sales of ZWL$415 million. The group attributed the rise in revenues primarily to price increases effected during the period. Sales volumes were reported at 6% lower, with the company citing falling disposable incomes as cause.

- The group’s gross profits climbed by 160% to ZWL$4.6 billion and net operating profit increased to ZWL$3.6 billion.

- Net operating cash flows for the half year period stood at ZWL$1.2 billion while net cash flows were at ZWL$1.6 billion.

- Total assets decreased marginally to ZWL$7.6 billion, and total liabilities where at ZWL$3.2 billion.

- The group reported that it contributed ZWL$3.5 billion to the government coffers in various taxes during the half year period.

Commentary and Analysis

The group’s price increases appear to be well above what would have been necessitated by the cigarette excise tax hike and general inflation. It is highly likely that some component of the price hikes have been a result of maneuvering by BAT to reposition some of its cigarette brands. Specifically, the domestication of the traditionally imported “high-end” Dunhill brands through the repackaging of traditionally local “mid-market” brands Kingsgate and Newbury. This could in some part explain the fairly sharp increase in the group’s gross margins. BAT is effectively the only game in town for “high-end” cigarettes, and the response to the repackaged Dunhill brands seems to have been positive. With existing competition more focused on the value for money segments, and effective protection from imports, the group’s position does not appear to be under any immediate threat. Add to that, the group’s apparent economic significance, it is fair to suggest that BAT Zimbabwe faces far less existential uncertainty than most large scale cigarette manufacturers across the world. One might suggest that the revamped branding and packaging serve a dual purpose as a long term play to attract a more contemporary customer group in lining with the country’s changing demographics.

Looking ahead, the concern will be continuation of economic trends that are eroding local disposable income, and the pull of the “value for money” alternatives under the circumstances. The monetary losses are also concerning, but are likely related to hard-currency liabilities to related entities. If it is not already the case, the group would be expected to follow other large scale consumer linked manufacturers in establishing more direct distribution channels to the informal retail sectors where hard currency use is more prevalent.

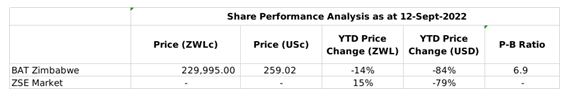

On the ZSE, the BAT Zimbabwe (BAT.zw) share has been fairly subdued. Since the start of 2022 the share has underperformed the market, losing 14% value in nominal terms and 84% in implied US dollar. As at 12 September 2022 the share was trading at a price to book ratio of 6.9x – Harare