By ETimes

Financial Performance Highlights

- Dairibord Holdings announced an inflation adjusted after tax profit of ZWL$1.75 billion for its financial year ended 31 Dec 2022. The performance was a 742% rise from the previous year.

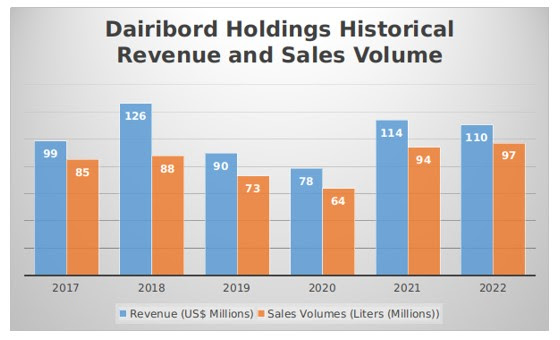

- Total revenues increased by 40% to ZWL$63.4 billion which was attributed to moderate growth in volumes and price adjustments. The groups raw milk intake increased by 4% to 28.5 million liters while sales volumes increased by 3% to 97.1 million liters. Beverages accounted for 62% of sales volumes and grew 7% from the prior year. Food accounted for 10% of sales volumes and grew by 10% during the year. Liquid milks accounted for 62% of sales volumes and declined by 7% during the year. Of the total sales volumes, US dollar domestic sales accounted for 50%, up from 17% in 2021 while export sales accounted for 6%, marginally up from 5% in 2021.

- The groups gross profit increased by 18% to ZWL$12.2 billion while operating profits (excluding non-core income) declined by 58% to ZWL$1 billion. The group noted the cost escalations experienced during the year due to imported inflation and pricing distortions from the currency instability. Other operating challenges noted were extended lead times throughout the supply chain, delayed forex disbursements, wage pressures, and inconsistent supply of electricity and clean water. Consequently, costs of sales and overheads grew by 46% and 48.5% respectively which saw the gross profit margin decline to 19% from 23%, and the operating profit (excluding non-core income) margin decline to 2% from 5%.

- The groups net cash flow from operations declined by 30% to ZWL$2 billion. However, through increased borrowings the group increased its net investment expenditures by 81% to ZWL$1.8 billion.

- At the end of the year, total assets stood at ZWL$35.95 billion, with cash holdings of ZWL$1.8 billion, inventories of ZWL$8.7 billion and receivables of ZWL$6 billion. Total liabilities stood at ZWL$17.5 billion, with borrowings of ZWL$3 billion and payables of ZWL$10 billion.

- Going forward, the group expects the cost pressures to persist in the 2023 financial year and will explore alternative energy and efficient production strategies to address the issues. Volume growth is anticipated following capital investments in a third maheu line, a drinking yogurt line, improved Steri-milk packaging production capacity and a new chilled water plant. The group will continue to pursue value addition opportunities, effective pricing models and optimize its product distribution channels.

- The group declared a dividend of ZWL$1 per share, payable on or about the 31st of May 2023.

- Ms. R. Ndoro took over the Group CEO position from the long-serving Mr. A. Mandiwanza with effect from the 1st of October 2022. Prior to the appointment she served as the Group Finance Director.

Commentary and Analysis

Its a financial performance that was weighed down by the general challenges associated with the local business environment. The reduced cash flows led to a moderate increase in debt to fulfil the groups capital investment plans and pad up cash holdings. Its a concerning development in light of the high interest rate environment, and the lack of any apparent resolution measures to the environmental challenges affecting the group. There is also the rising competition from Innscor’s ProDairy business unit across most of the dairy food markets. Since 2019, Dairibord’s annual sales volume growth has averaged 5.3% per financial year while Prodairy has averaged 40%, with aggregate 3 year growth for ProDairy at 258% versus Dairibord at 33%. The competitive pressure and persistent economic strain on consumers puts an emphasis on Dairibords ability to maintain price competitiveness to defend its market position – having to do so in the face of environmental challenges and rising debt costs. The sharp rise in the groups trade payables suggests a need to raise additional short-term debt in the new financial year.

So, barring a sustained improvement in the operating environment, the group will have to continue absorbing the costs associated with the turbulence. The resulting reduction in operating cash flows combined with the high interest rates will likely prevent the group from making any significant investments towards capacity. ProDairy, backed by the ample financial resourcesand value-chain integration of the Innscor group stands to continue expanding its presence in the major dairy food markets. Dairibord now has to anchor its growth on creating new innovative product lines and markets. However, these initiatives are likely to be frustrated by the prevailing operating environment. So, in the short-term the groups profitability is likely to remain depressed, although increased forex earnings from domestic and export sales may ease pressure on the margins. The long-term outlook is uncertain, with the failed merger with Dendairy raising questions about the group’s capacity to compete viably in the long-term. A near future with an improved long-term economic outlook could have scope for Dairibord to raise capital and increase its competitive capacity – if its feasible.

On the ZSE, since the start of 2023, the Dairibord share has gained 487% in nominal terms and 22% in implied USD terms. The share is currently trading at Price to Book ratio of 2.0x – Harare

Place your advert at affordable rates