By ETimes

Financial Performance Highlights

- ZimRe Holdings announced an inflation adjusted profit after tax of ZWL$4.1 billion, a 57% decline from the 2021 comparative.

- Total income grew by 9% to ZWL$39.5 billion as Gross Premiums Written increased by 13% to ZWL$20.4 billion while fair value adjustments gained ZWL$17.9 billion.

- Total expenditures increased by 36% to ZWL$30.1 billion, with benefit and claim payouts increasing by 17% to ZWL$7.3 billion.

- The groups net cash flows from operations increased by 361% to ZWL$8.6 billion which supported investment expenditures of ZWL$2.3 billion, 23% lower than the 2021 comparative.

- The groups total assets stood at ZWL$122.2 billion, comprised of investment properties of ZWL$68.2 billion, financial assets of ZWL$11.2 billion and cash holdings of ZWL$10.9 billion.

- Total liabilities stood at ZWL$71.3 billion,, with life insurance contracts of ZWL$24.5 billion, short-term insurance contracts of ZWL$7.8 billion and investment contracts of ZWL$18.1 billion.

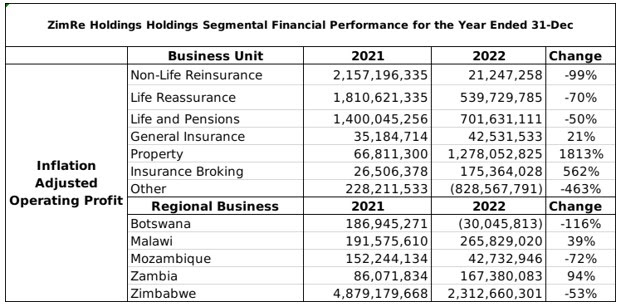

- The Non-life Insurance saw profits decline by 99% to ZWL$21.2 million. According to the group, local non-life reinsurance operations were hit hard by high agriculture claims, which saw the claims ratio rise to 71%. The group also noted that local operations and administration expenses spiked due to exchange rate developments.

- The Life Reassurance segment also saw a sharp decline, with before tax profits falling by 70% to ZWL$540 million. The general insurance segment gained 21% to ZWL$42.5 million while insurance brokering increased by 562% to ZWL$175.4 million.

- Driven by fair value gains, the property segment showed the highest growth at 1,813% to ZWL$1.3 billion.

- Among the regional businesses, Zimbabwe continued to be largest profit earner at ZWL$2.3 billion, despite a 53% decline. The declining economic growth in Botswana and Mozambique saw the profits in regional businesses also decline by 116% to -ZWL$30 million and 72% to ZWL$42.7 million respectively. The Malawi and Zambia fared better with profits increasing by 39% to ZWL$265 million and 94% to ZWL$167.4 million respectively

- Looking ahead, the Group will be launching its Eagle Real Estate Investment Trust (REIT) which will focus on infrastructure and landmark development with an emphasis on sustainability.

- The group declared a final dividend of ZWLc13.76 per share, which brought the total dividend for the year to ZWLc22.31 per share.

Commentary and Analysis

The group highlighted the adverse impact of a spike in agriculture insurance claims on its financial performance. It definitely played a part in the sharp profit decline experienced during the year, but the weak growth in GPW and Total (core) Income are also concerns. The other concern is the sharp rise in the groups payables and accruals during the year relative to the low growth in the core income streams. More guidance is required on the expected future behavior of agriculture claims, given that the group cited “the climate change effects” as the driving cause.

The group has made some concerted efforts to revitalize its operations and made two complementary acquisitions in the local insurance sector. Analysis of historical Total Insurance Income shows growth in the group’s core non-life reinsurance business has been fairly subdued in the last three financial years. The contribution of the acquired broking business remains low, but its area that has potential for an operation backed by the resources of a relatively large integrated financial services group. The acquired life and pensions business has materially increased the groups business, but declined significantly during the financial year. With the Zimbabwe’s economy struggling to create significant formal employment, persistent inflation keeping disposable incomes depressed, and competition from First and Old Mutual, it is arguable that the life and pensions business does not promise much short to medium term growth. On the upside, the group was able to acquire the controlling stakes in the new businesses without incurring any burdensome long-term debt.

Going forward, the group may well be looking to unlock some value from its investment property portfolio with the anticipated listing of the Eagle Real Estate Investment Trust (REIT). It would be interesting to see how the funds raised from the listing could be utilized by the group. Analysis of historical Total Insurance Income indicates that sustained growth in the group’s external operations has been a challenge, while the domestic growth has been largely driven by acquisitions. Interestingly, the group has highlighted an intent to capacitate the groups regional units and further expand its footprint on the African continent. The groups other strategic focus, “a new investment focus towards infrastructure and landmark development” lines up with exploiting the high demand for investment grade property assets – which could be another avenue. Whichever way, the group needs to establish another growth center.

On the ZSE, since the start of 2023, the ZimRe share has gained 199% in nominal terms and 98% in implied USD terms. The share is currently trading at a price to book ratio of 0.3x – Harare