By Yona Banda

Financial Performance Highlights

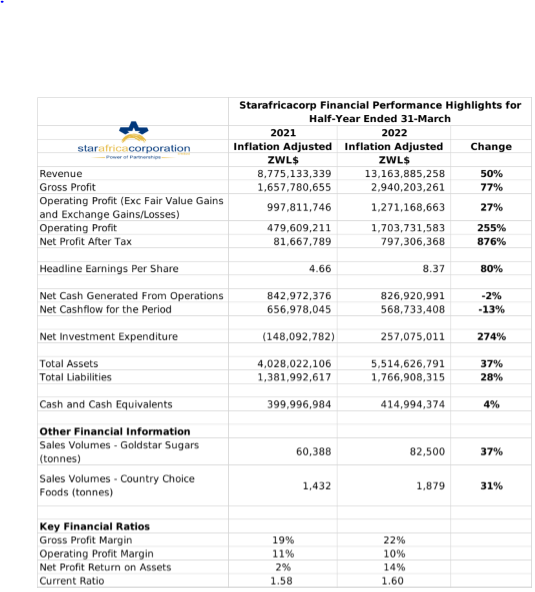

- Listed sugar refiner Starafricacorporation earned an inflation adjusted Net Profit After Tax of ZWL$797.3 million for its financial year ended 31 March 2022. The result represented an 876% inflation adjusted rise from the 2021 financial year.

- The performance was driven by rising sales volumes, with sugar sales rising by 37% to 82,500 tonnes. The rise was attributed to improved production capacity from capital investments and equipment maintenance as well as rising domestic demand.

- Country choice food sales volumes increased by 31% to 1,879 tonnes. This credited to the commissioning of syrup filling and icing packing machines that improved production capacity.

- The volume growth saw the group’s inflation adjusted revenues rise by 50% to ZWL$13.2 billion, while gross profits rose by 77% to ZWL$2.9 billion.

- Fair value adjustments of ZWL$386 million contributed to the group’s operating profit, which stood at ZWL$1.7 billion – representing a 255% rise. Adjusting for the non-operating income placed the year on year inflation adjusted growth at 27% to ZWL$1.3 billion.

- The group earned a profit share equivalent to ZWL$54.31 million from its interest in Tongaat Hullett Botswana.

- The group’s operations produced a net cash flow of ZWL$826 million, which allowed net investment expenditures of ZWL$257 million.

- Total assets stood at ZWL$5.5 billion with cash holdings of ZWL$420 million and total liabilities were at ZWL$1.7 billion.

- There were some executive changes during the period as Mr. R. Mutyiri resigned as a Director and Chief Executive Officer and was replaced by Mr. R. Nyabadza while Mr. F. M. Myambuki was appointed as Finance Director.

- The group did not declare a dividend, with internal resources to be channeled towards retooling the business, and increasing productivity in the strategic business units.

Commentary and Analysis

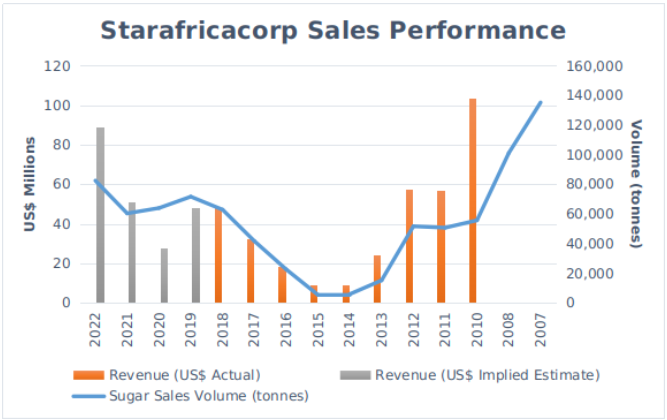

In terms of sales performance, the group has steadily recovered from its near collapse in the middle of the last decade. The sugar sales volumes remain significantly below pre-2010 levels, but the implied USD revenue was the group’s highest since. It appears that the group has the capacity to increase its scale of business. However, financial capacity stands to limit the group’s short term growth potential as access to significant credit facilities is unlikely. In that context, focusing internally generated funds on maintaining and improving production efficiency seems a sensible immediate strategy.

In the immediate future, the key concern will be the worsening operating environment, as the group has frequently highlighted the disruptive effect of the country’s erratic power supply. Otherwise, expectations are for demand to be relatively resilient for refined sugar products. The other concern is the ZWL$687 million reported as a net less on monetary position during the financial year. The basis of the loss was not elaborated in the financial statement notes, and the liabilities it could be stemming from are unclear after the group reported the settlement of its legacy debts.

As an aside from financial matters, it would be interesting to know the structure of the group’s product distribution channels – as a whole but particularly for its country choice products. At some point in the past the group emphasized partnerships, and it would be highly illuminating to know how much connection the group has to the hospitality and food-processing sectors. In the retail sector at least, there could be something in upgrading the branding and packaging of country choice products to make them stand out a bit more or make a bigger emphasis on the product quality

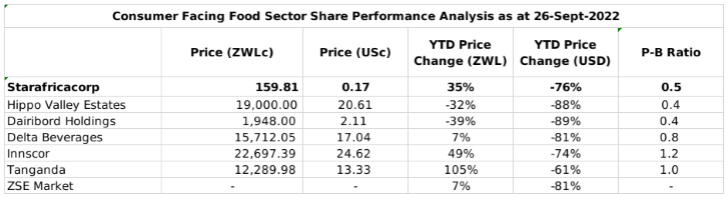

On the ZSE, since the start of 2022 the Starafrica share has gained 35% in nominal terms and lost 76% in implied USD terms. The share is currently trading at a price to book ratio 0.5x which is closely aligned with peer sugar refiner Hippo Valley Estates. The current price, at the implied value 0.17Usc is some way off the 3.00Usc that ZAMCO reported it would be willing to sell its majority stake in Starafricacorp. Under the current circumstances, it is difficult to see the share rising to that price, however it could be a valuable strategic acquisition for a large operator in the food and beverages sectors – Harare