By ETimes

Financial Performance Highlights

- For the financial year ended 30 June 2022, fast food services group Simbisa Brands reported an inflation adjusted After Tax Profit of ZWL$9.5 billion which represented a 77% rise. The group’s operating profit before depreciation, amortization and impairment increased by 38% to ZWL$5.7 billion.

- The group’s total inflation adjusted revenue climbed 76% to ZWL$72.9 billion. Domestic sales contributed ZWL$51 billion after a 48% rise.

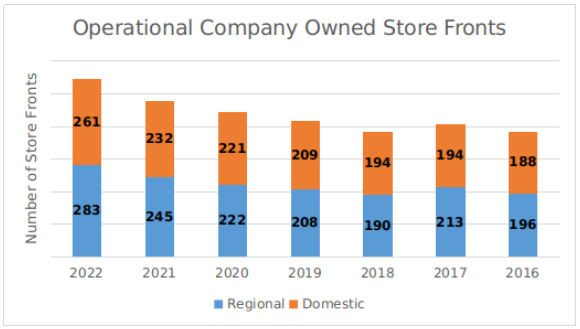

- The group reported counter trading hours at 28% below normal due to COVID-19 and curfew restrictions. Despite that, customer counts grew by 28% year on year and inflation adjusted ZWL$ average customer spend increased by 15.7%. During the year the group opened an additional 27 new stores to leave the total operational domestic outlets at 261.

- Inflation adjusted regional sales climbed 214% to ZWL$21.9 billion during the financial year. Despite rising inflation affecting the Kenyan market, the group reported a 32.8% rise in the customer count, citing new store growth, improved trading hours and promotional activities as key contributors. During the year Simbisa Kenya opened an additional 38 outlets to close at 206.

- The group’s Zambian operation benefited from a more stable economic environment, which saw the customer count rising by 19.7% and average spend rising by 24.2% in real terms. The operation recorded a 48.8% rise in USD revenue, and opened 2 Rocomamas restaurants and closed 1 under-performing pizza inn to close at 33 counters.

- The group’s Mauritian operation grappled with exchange rate depreciation, with a net of 4 closures to leave the total operational counters at 13. Despite that, the operation recorded a 3.1% average spend in real terms, which resulted in a 25.9% nominal topline growth.

- The Ghananian market also faced an inflationary environment which led to a decline in real average spend, but the operation saw its USD revenue rise by 24.2%. During the period the operation added 2 new counters to close at 25.

- In the franchise markets, DRC achieved revenue growth of 47.1%, after a 30.5% rise in the customer count, and a 12.7% increase in average customer spend. During the period, 12 new counters were opened to leave the total at 29.

- The group’s operations generated a net cash flow of ZWL$18.2 billion, which facilitated net investment expenditures of ZWL$18.7 billion. During the year investments were made into upgrading the groups Central Stores and Central Kitchen to increase storage capacity and efficiency. The initiative was undertaken to reduce processing times, enhance efficiencies, improve product quality, and minimize wastage.

- The group’s total assets stood at ZWL$70.4 billion, with cash holdings of ZWL$6.1 billion. The total liabilities reached ZWL$44.7 billion, with total borrowings of ZWL$4.9 billion.

- The Group expects to open 87 new stores in FY23, mainly in Zimbabwe (45) and Kenya (30) at a cost of about US$23 million, primarily through internally generated funds. The focus in the Zimbabwe and Kenya markets will be on increasing revenue streams through delivery channels. The new store openings will focus on penetrating underserviced areas, particularly in small towns and high-density areas.

- The group declared a final dividend of 0.58 USc per share.

Commentary and Analysis

It is fair to say that the past few years have been a sequence of materially disruptive events for Simbisa Brands. From the return of the Zimbabwean dollar in 2019, and its continuous depreciation, the onset of the COVID-19 virus at the end of 2019, and more recently the global economic fallout from the Ukraine-Russia conflict. The trend in the groups reported sales revenues mostly aligns with that, with domestic sales largely recovered after Zimbabwe’s initial hard COVID-19 lockdown regime. Given the group’s roots in Zimbabwe, it is fair to say its operations have become fairly adept at dealing with the country’s internal economic adversities. The sales performance of the group’s regional operations is slightly harder to read. The implied USD value of the 2022 sales suggests a significant contraction despite the group largely reporting growth in its key markets. However, there is a strong likelihood that this is due to currency conversion challenges from analyzing the financial figures, with the devaluation in the ZWL currency being conflated by devaluation in the regional market currencies.

Despite the turbulence of recent years, the group has accelerated its domestic and regional expansion strategy. The inconsistency between the trend in the group’s sales and the growth in outlets is slightly concerning but would be expected to be resolved in a more stable operating environment. The other upside is that the group has been able to finance the expansions without accruing unsustainable levels of debt. Most of the past and targeted expansion is concentrated in the domestic and Kenyan markets where the group has succeeded in building up strong market positions. Looking ahead, the immediate concern will be the disruptive external and internal economic shocks in the key markets. The long term concern is the ceiling on growth created by the systemic economic and sociopolitical issues in these key markets. There is also the added dimension of competitive pressure in the Kenyan market. In Zimbabwe, Simbisa has cornered the mass market for fast food, and without an improvement in consumer capacity, there could be an increasingly smaller space for growth.

On the ZSE, since the start of 2022 the Simbisa share has added 76% value in nominal terms and lost 69% in implied USD terms. The share is currently trading at a Price to Book ratio of 2.2x – Harare