…as FY2022 PAT rose 537% to ZWL$4.3bn

By ETimes

Financial Performance Highlights

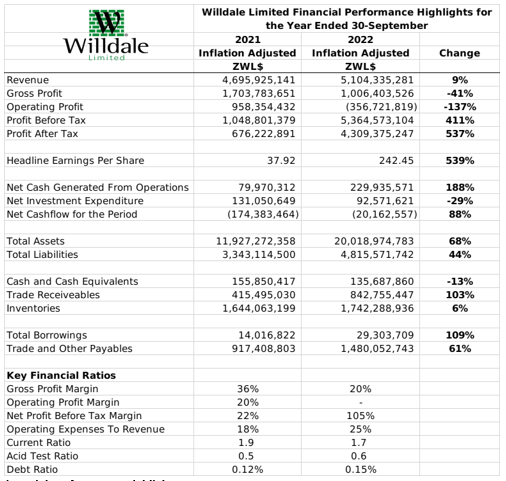

- Listed brick manufacturer Willdale Limited reported an inflation adjusted profit after tax of ZWL$4.3 billion for its financial year ended 30 September 2022- a 537% rise from the previous year. Fair value gains of ZWL$1.6 billion and monetary gains of ZWL$4.1 billion contributed significantly to the company’s performance.

- Operating profits were down 137% to a loss of ZWL$357 million, as the company reported net exchange losses of ZWL$66 million. Operating expenses increased by 49% in inflation adjusted terms, while the operating expenses to revenue ratio increased to 25% from 18% in the previous year.

- Gross profits fell by 41% to ZWL$1 billion, with the gross profit margin declining to 20% from 36% in the previous year.

- Total revenue for the year increased by 9% to ZWL$5.1 billion, while sales volumes fell by 9% due to production constraints caused by power supply challenges and late rains.

- The operation generated a net cash flow of ZWL$230 million, up 188% from the previous year and net investment expenditures stood at ZWL$92.6 million. The company has further capital investments planned for the next financial year to improve productivity and efficiency, with a new crushing plant expected to be installed.

- Total assets stood at ZWL$20 billion, comprising cash holdings of ZWL$136 million, receivables of ZWL$843 million and inventories of ZWL$1.7 billion. Total liabilities reached ZWL$4.9 billion, with total borrowings of ZWL$29 million and payables of ZWL$1.5 billion.

- Looking ahead, the company expressed confidence on the ongoing government efforts to stabilize the economy. The company expressed optimism that ongoing housing development and infrastructure projects will support demand for its products.

- A dividend of USc0.0056 was declared for the period, payable to registered shareholders on the 13th of January 2023 and to be paid in US dollars on or about the 22nd of January 2023.

Commentary and Analysis

The sharp decline in profitability should be a concern to the company as the current economic environment is likely to add further stress to its margins. It is also noticeable that the company went against the general trend by not investing significantly in working capital. Instead, a significant portion of the cash flows generated by the operation went towards paying dividends. Growth in Willdale’s revenues has been fairly subdued up to the financial year under review (See Graph). Given that sales volumes declined during the 2022 financial year, the upturn in revenue was likely driven by real inflation in construction materials. The historical revenue performance suggests the company has managed to tap into the apparent boom in local construction despite significant competition from small-scale informal/illegal brick manufacturers. With the current tight liquidity environment likely to put a squeeze on the informal operators, it may have been prudent for the company to withhold from declaring a hard currency dividend – more so considering its relatively short cash position and the rising local borrowing costs. It is possible that Willdale might capture some upside from the government’s infrastructure spending plans, although the increasingly strict trading terms being imposed on government contractors could be a concern. The long-term prospects of the company are tied-in with how the structure of the country’s construction sector develops. Ideally, the sector trends towards more formally regulated commercial property and infrastructure development.

On the ZSE, since 1 January 2022, the Willdale share has gained 0.3% value in nominal terms and lost 85% in implied US dollar terms. The share has a 12 month high of ZWLc429.90 and a low of ZWLc155.83, with a price to book ratio of 0.5x – Harare