By ETimes

Financial Performance Highlights

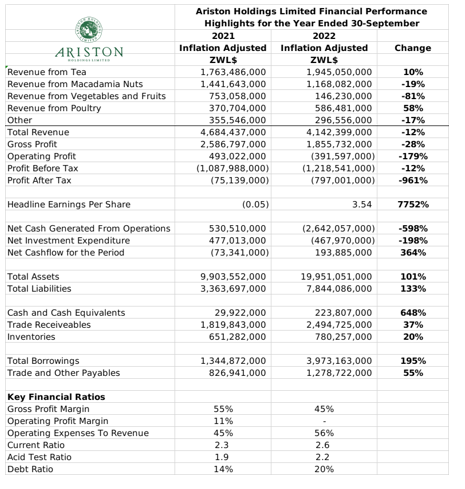

- Ariston Holdings Limited saw its after tax losses widen to ZWL$797 million in its financial year ended 30 September 2022 as the group incurred exchange losses of ZWL$1.6 billion. Commenting on the results, the group highlighted the adverse impact of the mismatch between the official exchange rate applied to surrendered export proceeds and the exchange rate applied by local supplied.

- Gross profits declined by 28% to ZWL$1.9 billion, as production costs increased by 9% to ZWL$2.3 billion.

- The group made an operating loss of ZWL$392 million, with operating expenses rising by 9% to ZWL$2.3 billion.

- Total revenues fell by 12% to ZWL$4.1 billion, which the group attributed to a reduction in the average selling price macadamia nuts as well as a decline in yield. The declining revenues saw the group’s gross profit margin decline to 45% from 55% and, the revenue to operating expense ratio rise to 56% from 45%.

- Revenue from tea sales increased by 10% to ZWL$1.95 billion, as production volumes increased by 15% to 3,158 tonnes during the year. Export sales volumes increased by 10% with the average export selling price declining by 1% during the period. Local sales volumes fell by 16%, although average selling prices increased by 12% in US dollar terms.

- Revenue from macadamia nut sales fell by 19% to ZWL$1.2 billion, as production volumes fell to 1,106 tonnes from 1,292 tonnes following a decline in yields. The average selling price for the macadamia nut fell by 21% during the period as the market experienced an oversupply after COVID-19 lockdowns restricted access to the Chinese market.

- Revenue from vegetable and fruit sales fell by 81% to ZWL$146 million while poultry sales increased by 58% to ZWL$586 million. Revenues from the group’s other outputs, which includes potatoes, commercial maize, soya beans, seed maize and bananas – declined by 17% to ZWL$298 million.

- The group’s net operating cash flows were at a deficit of ZWL$2.6 billion following the financial loss. Cash generated from asset disposal proceeds and loans allowed capital investments of ZWL$308 million. The investments were made towards planting new macadamia orchards, rehabilitating irrigation equipment, expanding the fleet of tractors and upgrading macadamia drying facilities to increase capacity.

- At the end of the financial year the group’s total assets stood at ZWL$20 billion, with cash holdings worth ZWL$224 million, receivables of ZWL$2.5 billion and inventories of ZWL$780 billion. Total liabilities stood at ZWL$7.8 billion, with borrowings of ZWL$4 billion and payables of ZWL$1.3 billion. The group’s total borrowings increased by 55% during the period, increasing the debt ratio to 20% from 14%.

- Looking ahead, the group expects its future performance to be underpinned by the forecast for normal to above normal rains in the 22/23 agricultural season supported by continued focus on improving volumes and production efficiencies. The group expects the macadamia market to remain depressed in 2023, and tea prices and volume uptake to continue improving.

- The group did not declare a dividend for the period – citing the need to enhance assets and preserve cash resources.

Commentary and Analysis

The main concern from the results is Ariston’s rising debt relative to its exposure to price fluctuations in its key product markets. There is currently significant downside risk from rising geo-political tensions, global economic uncertainty and the re-emerging COVID threat. With the group appearing short on cash and having a large fixed cost base, adverse developments in the main product markets could drag it deeper into debt. Beyond that, in the long run there is a need for the group to diversify its operations towards more value-added product markets. This has to be the focus of the group’s capital investment as the global and local operating environment stabilizes. There is arguably a foundation for the group to evolve towards an integrated food processing and light-manufacturing operation.

On the ZSE, since 1 january 2022, the Ariston Holdings share has gained 24% in value and lost 81% in implied US dollar terms. The share has a 12 month high of ZWLc463.74 and a low of ZWLc210, with a price to book ratio of 1x – Harare