By Yona Banda

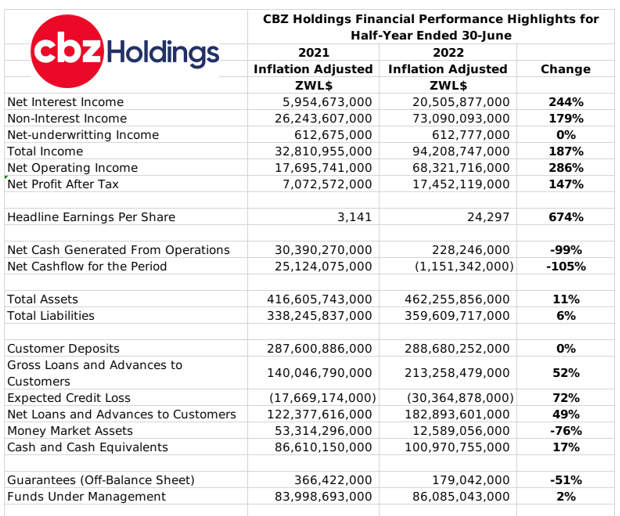

- Financial services group CBZ Holdings posted a ZWL$17.5 billion inflation adjusted net profit after tax for the 6 month period ended 30 June 2022. The performance was a 147% rise from the 2021 comparative period figure of ZWL$7 billion. Net operating income climbed by 286% to ZWL$68.3 billion, and headline earnings per share (HEPS) stood at ZWLc24,297.

- The performance was supported by a 244% rise in net interest income to ZWL$20.5 billion, while non-interest income rose by 179% to ZWL$73.1 billion. Growth in the insurance business was more subdued with net-underwriting income flat at ZWL$612 million.

- Growth in the groups customer deposits was flat at ZWL$288.7 billion, while the gross loan book grew by 52% to ZWL$213 billion. The loanbook remains significantly concentrated in the agricultural, with the sector accounting for 62% of the book. The services accounts for the majority of the groups deposits with a 58% contribution.

- The groups off-balance sheet liabilities stood at ZWL$179 billion and funds under management were at ZWL$86.1 billion.

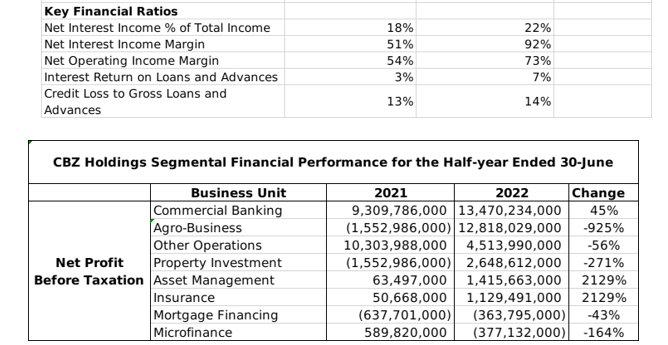

- The commercial banking unit remained the groups primary profit center with a net profit before tax of ZWL$13.5 billion. The Agro-business unit also contributed significantly with before tax earnings of ZWL$12.8 billion. The Asset Management and Insurance business segments registered the highest earnings growth in the period at 2129%. By contrast, the microfinance segment had the highest decline, with the before tax earnings falling by 164% to return a loss of ZWL$377.1 million.

Commentary and Analysis

The performance was significantly aided by technical gains comprised of ZWL$48.2 billion in unrealized foreign currency gains and net fair value gains of ZWL$4.7 billion. This removes a lot of gloss from the reported half-year figures with the performance appearing far more subdued. The significance of the agricultural sector to the group is increasingly prominent. As previously noted, the group has been angling for more control of the financial side of its collaborative agricultural funding schemes with the governments. The reported half-year figures from the agro-business operating segment would suggest the working arrangement is improving. Further, the majority of the growth in the loan book was concentrated in agricultural loans, which rose to ZWL$130.5 billion from ZWL$32.3 billion at the end of 2021. Heading into 2023, expectations are for the government to undertake an aggressive approach to agricultural funding and chances are high the CBZ group will benefit from the schemes. Looking ahead, the increased lending rates should support further growth in the groups non-interest income. The hope will be that income growth in the second half will steer the group away from undertaking any extreme operating cost containment measures.

The group’s market position remained relatively unchanged. The aggressive loan book growth saw the group gain some market share to 35.4% of the total banking sector loan book. The flat growth in deposits saw the group make a marginal loss in its market share, which declined to 25.8%. The performance might point to CBZ failing to match the other large banks in mobilizing foreign currency deposits during the period.

Beyond the internal issues, there is the intrigue behind the rumored merger between the group and fellow listed financial services group ZB Financial Holdings. However, there seems to be a fair amount of obstacles blocking the deal and it looks set to be drawn out process. On the ZSE, the CBZ share has fared better than its peers ZB and FBC. Since the start of the year the share has outperformed the bearish market, gaining 123% in nominal terms and losing 45% in implied USD terms. The share is trading at a price to book ratio of 1.3, which is higher than its listed peers – Harare