By Yona Banda

Highlights from financial performance

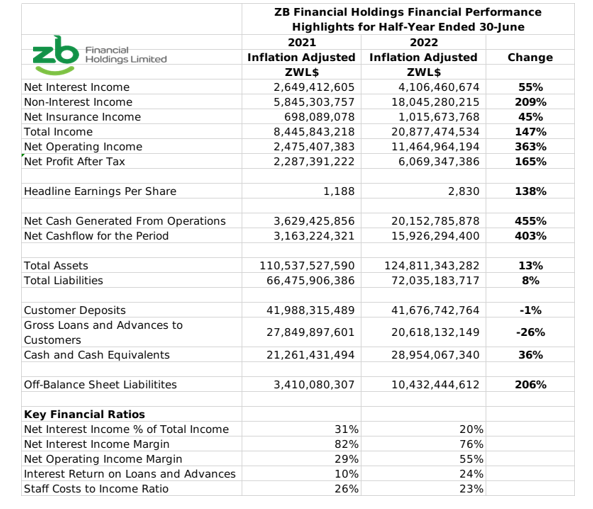

- ZSE listed financial services group ZB Financial Holdings earned an inflation adjusted half-year profit of ZWL$6.1 billion, which represented a 165% rise from the 2021 comparative period. The groups net operating profits reached ZWL$11.5 billion from ZWL$2.5 billion in the comparative 2021 period. Headline earnings per share stood at ZWLc2,830.

- The profitability was primarily driven by growth in non-interest income of 209% to ZWL$18 billion while interest income rose by 55% to ZWL$4.1 billion. The groups net insurance income increased by 45% to ZWL$1 billion.

- From the start of half-year, growth in the groups customer deposits was flat in inflation adjusted terms, closing the half year at ZWL$41.7 billion, after a 1% decline. The services sector was the main customer group, with 42% of total deposits, followed by private account holders with 18%.

- Gross loans and advances fell by 26% in inflation adjusted terms to ZWL$20.6 billion. Private individuals made up 36% of the groups loan book, followed by the services sector with 30% and financial organizations with 10%.

- The groups total assets stood at ZWL$124.8 billion and total liabilities stood at ZWL$72 billion. Off balance sheet credit exposures stood at ZWL$10.4 billion, comprised primarily of loan commitments of ZWL$6.6 billion.

- The banking operations remained the group’s core business, with before tax profits rising by 129% to ZWL$5.2 billion.

- The insurance segment before tax profits rose by 250% to ZWL$2.9 billion. According to the group, ZB Reinsurance earned a net profit after tax of ZWL$990.7 million and ZB Life earned ZWL$1.285 billion. The group also reported that its expansion into the Botswana insurance market had commenced operations on 1 June 2022.

- Beyond financial matters, the group reported on its ongoing organizational transformation program geared towards digitization and customer service excellence. The project is expected to be completed in Q3 2022.

- The group also reported that as at 30 June 2022, it had converted 14 of its branches into one-stop customer service centers.

- The group declared a dividend of ZWLc77.18 for the half-year period.

Commentary and Analysis

It is difficult to take the performance at face value because the primary source of the profit rise is under defined in the half year financials. The results reported earnings of ZWL$11.1 billion under “operating income”. It is probable that the figure refers to net realized or unrealized foreign currency gains. It’s an endemic issue that is negatively affecting the validity of earnings as a reasonable performance measure for local companies.

In terms of market performance in its core business segment, ZB Financial Holdings saw some marginal decline in its market position. The slow growth in deposits saw its market share fall to 3.7% from 4.1% at the end of 2021. The groups primary deposit holders are private individuals and service industry operators, which aligns with the strategic emphasis on customer service excellence and digitization. The group’s share of the industry loan book also shrunk to 3.4% from 5.4% at the end of 2021. With cash and cash equivalents holdings of ZWL$29 billion and the recently raised lending rates, expectations are for the group to take a more aggressive lending strategy.

Under the apparent focus on mass retail banking, it feels like ZB bank is losing its stature as one of the country’s premier banking brands. The softer, friendlier logo certainly suggests an organization shifting towards a new identity. The worry is that, with a relatively small share in a market characterized by high levels of turbulence and competition, and limited scope to raise any extensive capital, the ZB group will struggle to compete for growth. While it’s not impossible to for the group to improve its market standing, it is not hard to imagine why the purported merger with CBZ might be ideal for ZB.

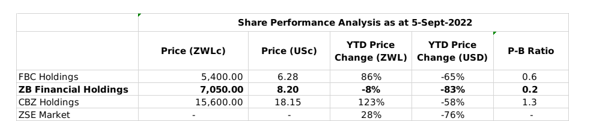

The ZB Financial Holdings share has not been spared from the bearish market fallout. The share has performed the weakest among its peer banking group stocks, and under-performed the market as a whole. It has lost 8% in nominal value and 83% in implied US dollar terms, with its price to book ration estimated at 0.2 as at 5 September 2022 – Harare