By ETimes

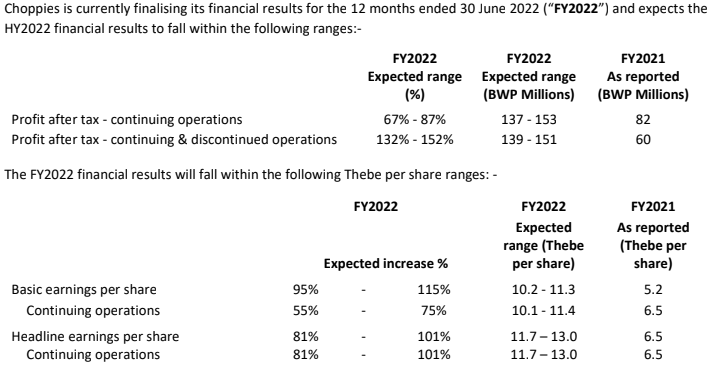

Choppies expects full-year basic earnings per share to rise between 95% and 115%, the Fast Moving Consumer Goods retailer said recently, but is currently finalizing its financial results that will be published next Thursday.

In addition to Botswana, which operates over 90 supermarkets, Choppies also has operations in Zimbabwe, Zambia, and Namibia, while operations in South Africa, Kenya, and Mozambique have been discontinued.

“In terms of the Listings Requirements of the Botswana Stock Exchange (BSE) and the JSE Limited (JSE), companies are required to publish a trading statement as soon as they become reasonably certain that the financial results for the period to be reported on next will differ by more than 10% (in the case of the BSE) or more than 20% (in the case of the JSE) from the financial results reported for the previous corresponding period,” the company said in a trading update.

The estimated financial data that this trading statement is based on has not been examined or reported on by the firm’s external auditors, according to the company.

“Accordingly, shareholders are advised to exercise caution when trading in the company’s securities until such time as the actual results are released,” it said.

“The company expects to release its FY2022 financial results on or about 22 September 2022.”

The group achieved its first profit since 2016 as the benefits from restructuring the business, following the exit of underperforming investments, continued to be realised.

After tax profit was up 116% to BWP59.6 million in FY2021 from a loss of BWP371 million in FY2020.

But revenue was down 2% to BWP5.3 billion in FY2021 from BWP5.4 billion in FY2020. This was attributed to negative volume growth in Botswana due to the impact of the Covid-19 pandemic on the economy and consumer spending.

The Rest of Africa revenue rose 2.2% to BWP1 186 million in FY2021 on inflationary increases in Zimbabwe and Zambia, which were further offset by negative fluctuations in currency exchange rates.

The group has previously said that operating in this market is highly challenging due to the fluctuations and volatility of the Zimbabwean currency since gains made at the national level are lost when converted at the group level due to the weaker currency when compared to the Botswana Pula.

Botswana is by far the major segment of the group, making up 78% of total revenue. On a comparable basis, five years ago, Botswana made up 71% of the group. The decline in the Rest of Africa is due to currency depreciation – Harare