By ETimes

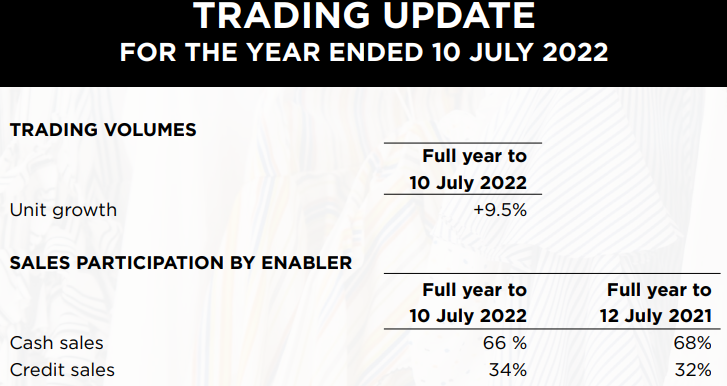

Truworths says the tight pricing restrictions, which made things pricey in US Dollar terms but cheaply priced in local terms, had a negative impact on sales and profits in the full year ended 10 July 2022.

For businesses, there is scarcely any good news because rising wage demands and higher input costs represent a double blow.

Of late, businesses have seen an increase in foreign currency transactions after the return of the greenback. In January 2021, the apex bank put a 20% retention threshold on local foreign currency sales.

Previously, the clothing retailer warned that its cash flows and profitability would suffer as a result of the official rate’s 20% retention on US dollar sales that are liquidated.

“Sales and profitability were adversely affected by the restrictive pricing laws which rendered products expensive in US Dollar terms and lowly priced in Zimbabwe Dollar terms,” said the company’s chief executive officer Bekithemba Ndebele in a trading update.

“This was further exacerbated by the widening gap between the official exchange rate and the market exchange rate.”

Meanwhile, the company pushed forward the publication of its full-year results.

“The full year audited financial statements, which were due to be published on 10 October 2022, will be published on 30 November 2022,” he said.

“This extension in publication was granted by the Zimbabwe Stock Exchange on 5 October 2022.”

Since there is pressure on sales volumes in the current market, it is obvious that businesses are now concentrating on how to retain value by efficiently managing expenses and seeking good credit management – Harare