By ETimes

The ZSE All Share Index went further up by 419.50 points representing a 2.67% gain to close at 16 138.51

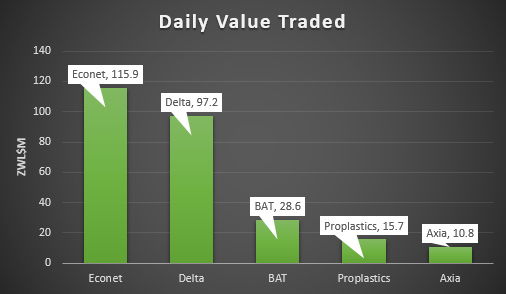

Gains were driven by Innscor which is trading under a cautionary statement as it seeks to move to the foreign currency traded VFEX. The conglomerate saw a $56.24 jump to $437.00, as the most valuable company Delta was $12.6181 up at $298.25.

Sugarcane farmer and refiner Hippo Valley added $9.96 to trade at $180.00 at the close of the session.

Zimplow gained $0.96 to $16.9579 as the country’s biggest retailer by outlets and customer count OK Zimbabwe was up $0.93 to close the day with a share price of $30.98.

The gains were partially erased by losses recorded in African Sun which retreated by $2.48 to close at $21.82. First Mutual Holdings which is awaiting competition tariff commission’s verdict on its merger with CBZ lost $2.34 in the session to $20.9641.

Properties firm Mashonaland Holdings traded $2.00 lower at $15.00 as clothing retailer edgars saw its share price decline by $1.05 to $8.05 whilst Meikles eased $0.97 to $101.03.

In the derivatives market, the OMTT added $0.53 to $6.03 as the DCMS moved $0.04 up to $1.60 as they were the only ETFs to record gains.

The MCMS and CSAG ETFs remained flat at $23.95 and $1.75 respectively. The MIZ ETF was the sole loser of the day as it decreased by $0.05 to $1.14.

TIGERE REIT added $1.70 to $35.70

Commodities

Gold prices edged higher on Tuesday as the dollar dipped, though lingering worries about further rate hikes from the US Federal Reserve (Fed) kept the non-yielding bullion’s gains in check.

Spot gold was up 0.3% at US$1 792.75 per ounce, as US gold futures rose 0.2% to US$1 801.40.

The dollar index inched 0.4% lower as the yen surged after the Bank of Japan said it would review its yield curve control policy. A weaker dollar makes gold more attractive to overseas buyers.

Spot silver edged 0.5% higher at US$23.06, platinum rose 0.3% to US$982.51 and palladium was up 0.6% at US$1 679.58.

Oil prices edged up on Tuesday, supported by a softer dollar and a US plan to restock petroleum reserves, but gains were capped by uncertainty over the effects of rising Covid-19 cases in top oil importer China.

Brent crude futures were up US24c, or 0.3%, at US$80.04 a barrel, adding to a US76c gain in the previous session.

US West Texas Intermediate (WTI) crude futures rose US49c, or 0.7%, to US$75.68 a barrel, after climbing US90c in the previous session.

Oil prices have been buoyed by a US plan announced last week to buy up to 3-million barrels of oil for the Strategic Petroleum Reserve following 2022’s record release of 180-million barrels from the stock – Harare