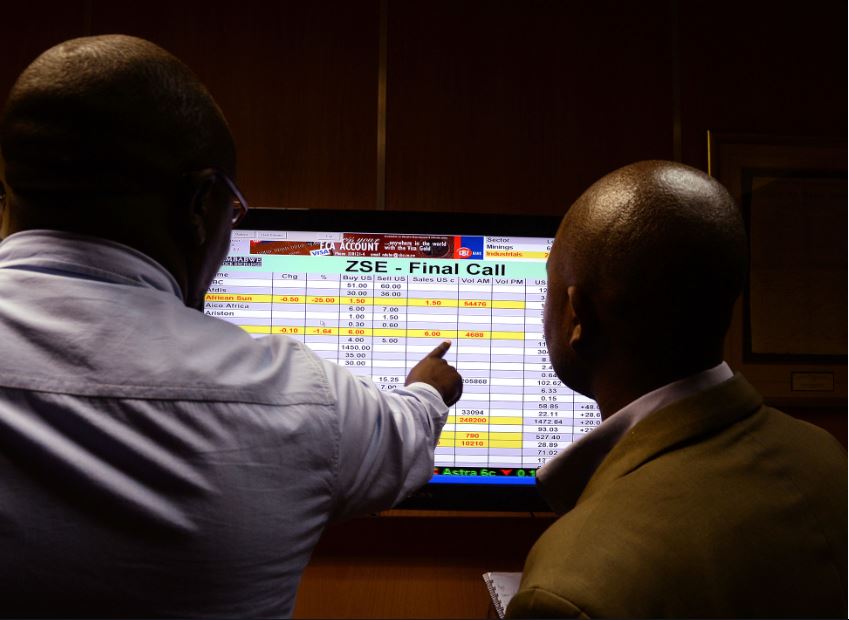

The Zimbabwe Stock Exchange opened the holiday-shortened week on a positive note. Accordingly, the mainstream ZSE All Share Index gained 2.45% to close at 15,719.01 points.

Overall, the market breadth was positive, with 13 counters trading in the positive versus 8 laggards.

Similarly, the investor’s wealth on the local bourse increased by $38.09 billion to $1.64 trillion.

The Top 10 Index gained the most, up 3.51% to close at 9,279.28 points. Among the heavyweights, Delta and Innscor rose 7.64% and 4.66% to end at $285.62 and $380.76 respectively.

On the flip side, Ecocash lost 0.96% to close at $35.5949.

The Medium Cap Index added 0.23% to 34,685.657 points. ART recorded the highest price gain of 14.71% to close at $13.00. Starafrica gained 6.39% to close at $1.49.

On the other hand, FML led the losers’ chart by 2.89% to close at $23.30. Ariston trailed with a decline of 1.76% to end at $3.74 while FBC went down by 0.82% to finish at $62.00. African Sun lost 0.59% to close at $24.30 completing the top 5 losers’ set.

The Small Cap Index recovered 0.96% to close at 443,417.94 points. Fidelity garnered 5.96% to $24.00.

Market turnover declined by 72% to close at $85.79 million. Transactions in Delta topped the activity chart with 215,000 shares valued at 61,410,330. Innscor followed with 26,600 shares worth $10,128,270.

Old Mutual ZSE TOP 10 ETF added $0.0473 to $5.5000. Morgan & Co Multi Sector ETF and Morgan & Co Made In Zimbabwe ETF remained flat at $23.9500 and $1.1868 respectively. CASS Saddle Agriculture ETF decreased by $0.0300 to $1.7500 whilst Datvest Modified Consumer Staples ETF shed $0.0475 to $1.5525

Tigere Real Estate Investment Trust remained flat at $34.0000.

Commodities

The rand firmed as much as 1.9% to the dollar after the ANC voted to keep President Cyril Ramaphosa on for a second term. Ramaphosa beat rival former health minister Zweli Mkhize by more than 500 votes.

Gold prices were steady on Monday as prospects of further interest rate hikes by the US Federal Reserve (Fed) in 2023 countered support from a tepid dollar.

Spot gold held its ground at US$1 792.19 per ounce as US gold futures rose 0.2% at US$1 802.80. The dollar index dipped 0.1%. A weaker greenback makes bullion more attractive to holders of other currencies.

Oil rose on Monday after tumbling more than US$2 a barrel in the previous session as optimism over the Chinese economy outweighed concern over a global recession.

China, the world’s top crude oil importer, is experiencing its first of three expected waves of Covid-19 cases after Beijing relaxed mobility restrictions but plans to step up support for the economy in 2023.

Brent crude gained US37c, or 0.5%, to US$79.41 a barrel while US West Texas Intermediate crude rose US30c, or 0.4%, to US$74.59.

Weekly Review

On a weekly review, the ZSE All-Share Index (YTD 41.77%) closed the past week 4.20% higher at 15 342.97 compared to 14 725.07 in the prior week.

In the week ending December 16, 2022, market breadth was negative with 22 gainers led by Axia which gained 48.50% against 15 fallers led by ART which eased -20.19%. Weekly market turnover of $1.22 billion was led by Delta $525 million, Econet $256 million, Innscor $230 million, OK Zim $64 million, and Hippo $25,3 million.

On the ETFs section Morgan & Co Multi Sector was the biggest gainer, after rising by 14.05% from $21.00 to $23.95, while Morgan & Co Made In Zim was the biggest loser after falling by 8.71% to $1.19.

On the VFEX, Simbisa was the biggest gainer after rising by 7.38% to US31.00 cents.

Karo Mining Holdings plc bond listed on the VFEX on the 16th December 2022, becoming the seventh counter and the first to issue bonds since the exchange, which deals in shares denominated in US dollars, opened two years ago.

Mixed trading with a bias towards a continued price recovery due to an observed rise in buying momentum and improved liquidity in the market is expected by investment research firm Platinum Securities – Harare