By Yona Banda

Financial Performance Highlights

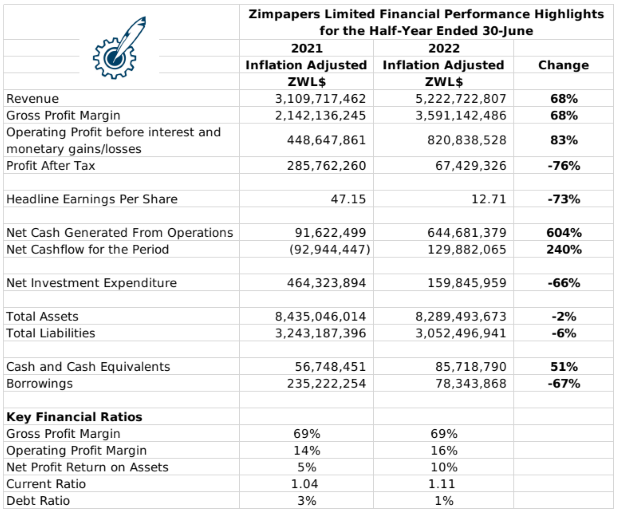

- Listed media company Zimpapers announced an inflation adjusted after tax profit of ZWL$67 million for its half-year ended 30 June 2022. The bottomline growth was significantly dampened by exchange and monetary losses of ZWL$431 million. In contrast, operating profit rose by 83% to ZWL$820 million and gross profits increased by 68% to ZWL$3.6 billion.

- The newspaper’s operation was the company’s most profitable segment at ZWL$813.3 million, after advertising volumes increased by 24% and circulation rose by 6%.

- Commercial printing showed the sharpest profit growth at 1089% to ZWL$77 million. The performance was driven by a 45% recovery in volumes, with labels rising by 48%.

- The radio broadcasting division earned an operating profit of ZWL$161.8 million. The segment’s ZWL$115 million loss stemmed from the ZTN Project, which saw the group launch a DSTv channel on the 24th of May 2022. According to the company, the channel is gaining traction on revenue generation and audiences.

- The company’s operations generated a net cash flow of ZWL$645 million, which financed capital expenditures of ZWL$160 million.

- The total assets stood at ZWL$8.3 billion, with cash holdings of ZWL$85 million and total liabilities stood at ZWL$3.1 billion, with borrowings of ZWL$78 million.Looking forward, the company will aim to strengthen its product portfolio and improve profit margins. The company expects the ZTN footprint to continue growing, and increasing digital products and services will be a key strategic thrust.

- The group did not declare a dividend in view of the challenging operating environment.

Commentary and Analysis

Zimpapers is an interesting case as the country’s only listed media house. The company’s operations are seemingly built on a set of industries with waning influence. The internet and social media are now the primary source of information over newspaper print. Similarly, the internet through paid subscription or free access platforms is becoming the primary source of entertainment over television. The move into television looks worse when considering that local access is contingent on having an active DSTv account – something out of reach for the majority of the audience. The key point is that internet platforms are more accessible and increasingly the focus of corporate advertising, and that trend will only continue. At the same time, the government of Zimbabwe holds a special interest in Zimpapers. This interest has created strategic benefits for Zimpapers that, barring some significant changes, will remain in place and keep the company afloat foreseeably. Otherwise, it will take some innovative and brave thinking to alter the trajectory of the company to something more exciting. It would be a pivot, but there might be something in online consumer information services like Hippo.co.za – set up with the anticipation for more competitive markets for financial products under a recovering/growing Zimbabwean economy.

On the ZSE, since the start of 2022 the Zimpapers share has gained 3% value in nominal terms and lost 76% in USD implied terms. The share is currently trading at a price to book ratio of 0.2x –Harare