By ETimes

The Zimbabwe Stock Exchange (ZSE) declined on Wednesday as the mainstream index fell 0.26% but the loss was powerful enough to cancel the pre-independence holiday gains at a time when the macroeconomic environment has remained generally volatile.

This comes as the Zimbabwean dollar depreciated by 4.24% against the US dollar in Wednesday’s trade to close the week at $1,000, as demand for foreign currency soars.

Last week, the local unit was at $959,31.

At $1000 against US$1, it is far from the US$1:$1700x parallel market rate.

IH Securities (IH) expects the theme of dollarisation within the economy to continue in the future despite authorities’ efforts to ramp up the use of the local currency.

A January 2023 ZIMSTAT survey report indicated that almost 80% of transactions for food purchases are in USD, with the rest in ZWL.

In both legal and unofficial marketplaces, where products and services are increasingly priced in US dollar, the local unit has continued to deteriorate in value versus the greenback. In addition, the cost of products and services is rising even in US dollars, a pattern that is expected to continue.

A total of US$18.9 million was allotted to 482 bidders at both the main and small enterprise auctions.

Meanwhile, the ZSE All Share Index was off 94.08 points to close at 36,124.87 points. Market capitalisation declined by $595.21 million to $2.99 trillion.

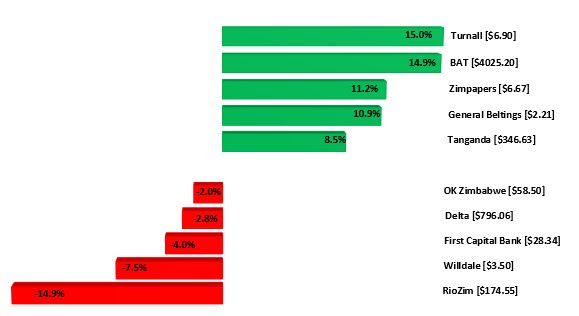

The Top 10 Index lost by a negligible 0.08% to end at 20,870.02 points, although BAT’s gain of 14.99% to close at $4025.20.

Delta slid to $796.06 recording 2.82% depreciation. OK Zimbabwe closed at $58.50 going down by 2.10%.

The Medium Cap Index was down 0.83% to close at 78,231.82 points.

RioZim was the worst performing stock, declining by 14.98% to close at $174.55. Willdale shed 7.53% to close at $3.50. First Capital Bank fell to $28.34, losing 4.07%.

Conversely, Tanganda added 8.55% to end trade at $346.63.

The Small Cap Index, the only gainer in the session, jumped 8.64% to close at 726,084.75 points.

Turnall appreciated by 15% to close at $6.90. Zimpapers went up 11.25% to $6.67. General Beltings rose to $2.21, notching up 10.98% in the process.

Investors traded 3.47 million shares worth $414.75 million in 295 deals, compared with 2.6 million shares worth $642 million in 188 deals previously.

The Morgan & Co Made In Zim ETF gained 2.0% to $2,0400. The Datvest ETF added 0.02% to close at $1.8600. Tigere REIT was up 0.0045 percent to $50.6193.

On the VFEX, Axia rose 0.50% to close at US$0.1005. In the red zone were Padenga, Innscor Africa Limited and Simbisa which eased 3.04%, 0.13% and 0.11% to close at US$0.2133, US$0.5995 and US$0.4200 respectively – Harare