By ETimes

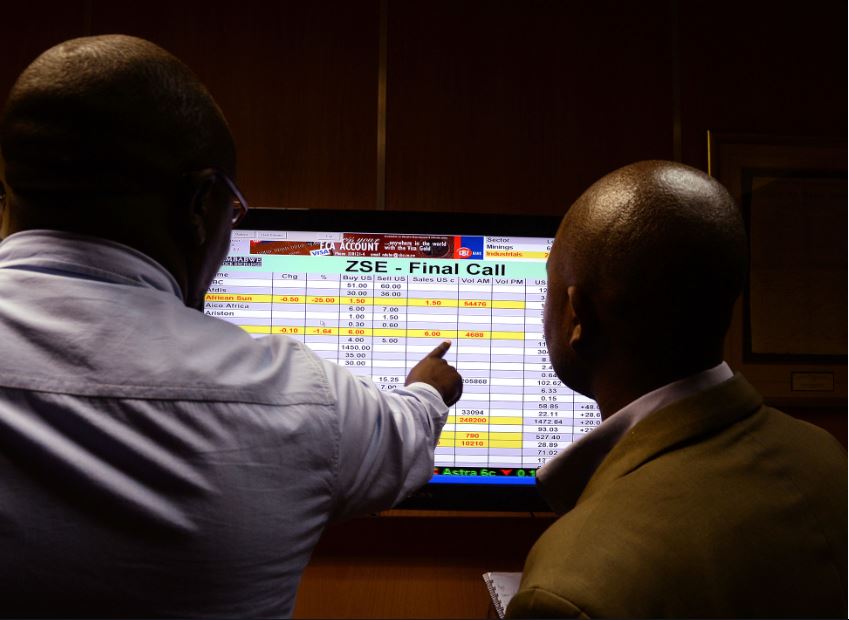

On Monday, equities trading at the Zimbabwe Stock Exchange (ZSE) ended bullish to halt four consecutive negative outings, as positive outings by Econet and other mid-tier stocks pushed the ZSE All Share Index upward.

Accordingly, the mainstream ZSE All Share Index appreciated by 0.12% to close at 36,218.95 points while market capitalisation increased by $28 billion to $2.99 trillion.

The Top 10 Index gained the most, up 0.85% to close at 20,886.22 points. Econet with 14.99% growth, led the gainers table to close at $189.85.

The Medium Cap Index was down 1.83% to settle at 78,936.58 points.

Construction firm Masimba led the losers’ chart in percentage terms with 11.74% to close at $147.17. Mash Holdings followed with a decline of 10.90% to close at $15.00. Edgars fell to $24.04, losing 7.50%. TSL plunged 7.46% to close at $102.52. SeedCo Limited closed at $200.00, going down by 6.98%.

Conversely, Starafrica grew by 13.05% to close at $1.93. Willdale followed with 4.56% to finish at $3.78. First Capital Bank rounded the top 5 gainers table with 1.41% to end at $29.54.

The Small Cap Index nudged up 0.08% to settle at 668,331.79 points. Bridgefort Capital added up 8.11% to end at $10.00.

Investors traded 2.6 million shares worth $642 million in 188 deals, compared with 1.77 million shares worth $754.01 million transacted in 233 deals previously.

Morgan & Co Multi Sector ETF garnered 10.84% to settle at US$29.9286. Morgan & Co Made In Zim ETF rose to US$2.0000, notching up 5.82%.

Datvest ETF plunged 0.34% to US$1.8595 while OML ETF declined by 0.21% to US$9.5412.

On the VFEX, Padenga appreciated by 10.16% to close at US$0.2200. Axia gained 0.90% to end at US$0.1000. Simbisa was up 0.11% to finish at US$0.4205.

On the flip side, Innscor Africa Limited fell 1.10% to end at US$0.6003 while SeedCo International eased 0.17% to finish at US$0.2895 – HARARE