By ETimes

The stock market closed the week higher, lifted by gains in select heavyweights as activity continued to improve.

This comes as the apex bank plans to tentatively launch its digital tokens backed by gold in the first week of May 2023 to offer a new investment option to the market.

Accordingly, the ZSE All Share Index was up 1.74% to close at 41,391.62 points while market capitalisation increased by $58.33 billion to $3.48 trillion.

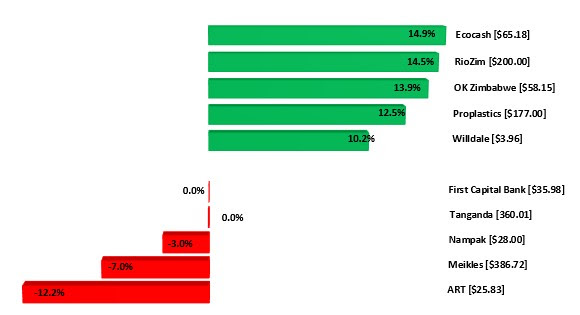

Ecocash led the gainers table, up 14.95% to close at $65.18. OK Zimbabwe jumped 13.95% to end at $58.15. As a result, the Top 10 Index gained 1.21% to finish at 23,764.03 points.

BAT was flat at $6800.00. BAT Zimbabwe finance director Wilson Chitsonga told an analyst briefing that they are working on a pricing model that is responsive to market developments.

“We are aware of the issue; we sell 100% in ZWL from the trade, but if we look at our wholesaler to the retail, they are actually selling in US dollars in other areas even in rands. but our consumers are basically buying our stick in ZWL,” he said.

“So, the plan is still in place, and we are actually doing system testing on our side just to make sure that we can accommodate demandable selling of currency.”

The company has not been spared from the exchange rate volatility despite continuously reviewing their selling prices of sticks.

“So, once that is done, I think the team is actually doing regression testing next week, so I think once that is done, we’ll be able to actually switch to the demandable currency, so the plan is actually in place for us to adopt market reality,” Chitsonga said.

Analysts say the company sells exclusively in local currency due to the fact that their parent company requires it to follow the laws of the country. The country has been ramping up efforts to increase the use of the local currency amid its continued depreciation against the US dollar.

The cigarette manufacturer has been undergoing restructuring and the team now comprises new faces.

The Medium Cap Index gained 3.23% to close at 91,349.20 points.

Gold miner RioZim was up 14.58% to finish at $200.00. Proplastics appreciated by 12.52% to close at $177.00. Willdale added 10.21% to end at $3.96.

ART suffered the most, falling by 12.43% to close at $25.83. Meikles eased 7.04% to end at $386.72. Nampak was down 3.08% to settle at $28.00. Tanganda depreciated by 0.04% to close at $360.01. First Capital Bank declined by a negligible 0.01% to finish at $35.98.

The Small Cap Index was flat at 739,049.37 points.

Turnover increased by 54.53% to $1.9 billion in 337 trades. Ecocash led the volume chart with 2.19 million units, while Delta topped the value chart with deals worth $1.16 billion.

Morgan & Co Multi Sector ETF added $1.5000 to close at $29.5000 while CASS Saddle Agriculture ETF gained $0.0100 to $2.0500. Datvest Modified Consumer Staples ETF increased by $0.0076 to finish at $1.7519 and Old Mutual ZSE Top 10 added $0.1355 to $9.4955.

Morgan & Co Made In Zimbabwe ETF shed $0.0042 to $2.0600

Tigere REIT added $0.0095 to close at $50.5095.

On the VFEX, National Foods was the only gainer with 1.17% to end at US$1.8313.

Innscor Africa Limited plunged 2.88% to US$0.5380. Simbisa and African Sun went down by 1.24% and 1.16% to end at US$0.4048 and US$0.0850 respectively – Harare