By ETimes

Profit-taking by investors on the Zimbabwe Stock Exchange impacted trading activities, as the mainstream All Share Index recorded marginal gains, forcing the market capitalization to appreciate by $3.96 billion.

Today’s performance comes as the Zimbabwe dollar continues to lose ground against the US dollar at the Reserve Bank of Zimbabwe’s (RBZ) weekly foreign currency auction, with the latest on Tuesday seeing it shed 6%.

The local unit eased to $779.31 to the US dollar, down from $732.00 in the last auction.

Businesses in Zimbabwe have the ability to accept payments in both US dollars and local currency, but the majority of them set their local currency pricing astronomically high in order to tempt customers to utilize foreign currency.

At the close of trading, the market breadth closed positive, recording 15 gainers and 11 losers.

Accordingly, the mainstream ZSE All Share Index increased by 25.97 points, or 0.12% to close at 21,861.40 points while the overall market capitalisation value appreciated by $3.96 billion to close at $2.35 trillion.

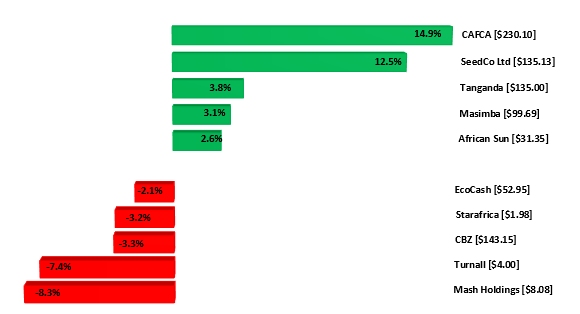

Losses in CBZ and EcoCash saw the Top 10 suffer the most, down 0.23% to close at 13,464.31 points.

Banking counter CBZ eased 3.32% to end at $143.15. There are questions in the market about whether the counter and ZB Financial Holdings are in common negotiations for a common or cross acquisition. This comes as they have both been issuing similar cautionaries in sequence since June 2022.

EcoCash was 2.14% lower to $52.95.

The Medium Cap Index gained the most, up 1.02% to settle at 44,359.31 points. SeedCo was up 12.59% to finish at $135.13. Tanganda gained 3.85% to close at $135.00. Construction firm Masimba climbed by 3.15% to close at $99.69.

Hotelier African Sun added 2.66% to trade at $31.35.

On the other hand, Mash Holdings led the losers’ chart in percentage terms, losing 8.37% to close at $8.08. Starafrica plunged 3.24% to close at $1.98.

CAFCA recorded the highest price gain of 14.99% to close at $230.10. As a result, the Small Cap Index recovered 0.69% to close at 477,354.34 points.

In the red was Turnall which fell 7.41% to close at $4.00.

Analysis of today’s market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 60% to $524.39 million in 241 deals.

Transactions in the shares of Delta topped the activity chart with 447,100 shares valued at $180.09 million. Innscor followed with 244,000 shares worth $165.31 million.

Datvest Modified Consumer Staples ETF gained $0.0116 to $1.5218 and Cass Saddle Agriculture ETF added $0.0018 to $2.2300 whilst Morgan & Co Made In Zimbabwe ETF and Morgan & Co Multi Sector ETF remained flat at $1.3000 and $23.2000 respectively.

The Old Mutual ZSE TOP 10 fell $0.0054 to $7.4606.

Tigere REITS retreated by $0.0280 to close at $50.5920 – Harare