By ETimes

The Zimbabwe Stock Exchange finished positive on Wednesday as the mainstream ZSE All Share Index nudged higher by 0.30% at the close of transactions.

Today’s performance comes as the World Bank maintained its 2022 and 2023 economic growth forecast for Zimbabwe at 3.6%.

WB forecasts use measurable and available data from the formal economy.

“That works well in largely formalized economies, and in that context, it can produce a broadly accurate view,” said one expert.

“Zimbabwe has one of the largest informal economies in the world as a proportion of economic activity; traditional growth forecasts will not be able to capture data on the significant value chains that exist in the informal sector. In my view, that makes it difficult to build a meaningful view based on these forecasts in a country structured like Zimbabwe.”

According to the 2023 national budget statement, the growth forecast is 3.8% during 2023. This will be sustained mainly by mining, construction and agriculture, as well as accommodation. This is almost in line with the IMF projections with the same key assumptions.

Economist Tarisai Pardon said the projection will be met or probably exceeded if currency stability is prioritized.

“The mining sector will drive much of the anticipated growth since we have a number of big mines expected to start production during the year, including the giant steel plant in Manhize. The agriculture sector, anchored by a good season and advanced winter wheat preparations, will also aid the projects,” he said.

“The construction sector, which will also see an increase in completed projects this year, is also significant. People are planning beyond elections already; they are working so hard that economic growth is inevitable.”

The market breadth closed positive, with 11 price losers and 14 price gainers, indicating that investor sentiment remained slightly positive.

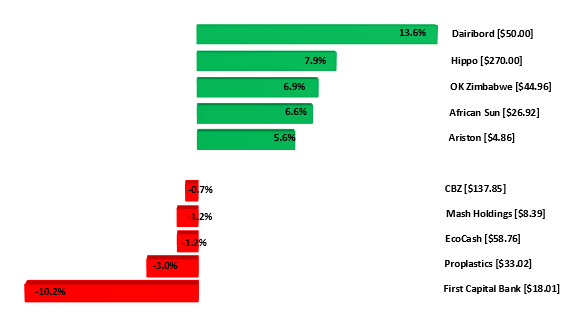

The Top 10 Index gained 0.25% to close at 13,821.00 points on OK Zimbabwe, which rose 6.92% to end at $44.96.

Partially offsetting the gains were EcoCash and CBZ which lost 1.25% and 0.79% to end at $58.02 and $137.85 respectively.

Dairibord gained 13.64% to become the best performing stock in the session. It is flanked by Hippo, African Sun and Ariston as they populated the top five gainers’ chart. From the rear of the chart, First Capital Bank, Proplastics and Mash Holdings populated the top five losers’ chart.

Value of those traded stocks dipped by 4.19% in the session to stand at $547.74 million as against a value of $525.69 million recorded in the previous trading session.

With regards to the value of traded stocks, Econet at $168.47 million took the lead of the top five performers, flanked by Delta at $165.36 million, Proplastics at $125.86 million, Innscor at $27.59 million and Axia at $17.77 million.

Market capitalisation increased slightly by 0.03% to $2.33 trillion.

Cass Saddle Agriculture ETF rose 0.01% to $1.8502.

However, the Datvest Modified Consumer Staples ETF eased 0.17% to close at $1.5109, Morgan & Co Made in Zimbabwe ETF gained 3.85% to $1.2500, Morgan & Co Multi Sector ETF was up 3.71% to $22.0182 and OM ZSE Top-10 ETF added 1.69% to $7.5021.

Tigere REIT was flat at $54.1500 – Harare