By ETimes

Financial Performance Highlights

ZSE listed financial services group ZB Financial Holdings (ZBFH.zw) reported a ZWL$678.5 billion profit for its half-year ended 30 June 2023, representing a 2179% rise from the 2022 comparative.

The sharp rise was driven by income growth of 796% to ZWL$917.3 billion, with fair value adjustments contributing ZWL$461.2 billion and other income accounting for ZWL$340.3 billion.

The group’s core revenue streams saw moderate growth, with net interest income rising by 262% to ZWL$32.3 billion, fees and commissions income rising by 257% to ZWL$68.1 billion and net insurance income rising by 210% to ZWL$15.4 billion.

The group’s financial performance was also enhanced by a 726% rise in the share of associate companies profit to ZWL$16.9 billion during the period.

The group’s operations generated ZWL$618.6 billion in cash flows, of which a net of ZWL$16.9 billion was invested internally, and an overall increase in cash and cash equivalence of ZWL$554.2 billion was reported for the period.

The groups Total Assets increased by 153% to ZWL$2.5 trillion while income earning assets increased by 186% to ZWL$606.7 billion, and cash holdings increased by 92% to ZWL$370.9 billion and the Total Shareholder Equity increased by 165% to ZWL$463.5 billion.

Total liabilities rose by 143% to ZWL$1.3 billion as total borrowings increased by 446% to ZWL$114.8 billion.

Total loans and advances to customers increased by 299% to ZWL$807.6 billion, with non-performing loans at ZWL$3.2 billion. The sector distribution of the loan book was relatively stable, with private individuals (26%), mining (24%) and services (20%) remaining the main groups main borrowers.

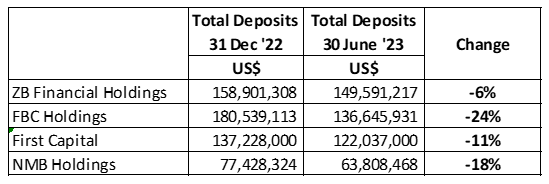

Total deposits increased by 152% to ZWL$858.6 billion, with services (41%), financial (24%) and private individuals (14%) the largest contributors.

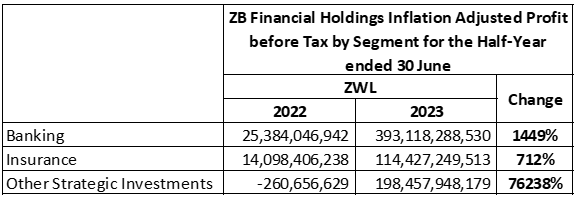

On the group’s operating segments, ZB Bank posted a profit after tax of ZWL$373.9 billion, up from ZWL$25.3 billion in 2022. ZB Building Society reported a profit after tax of ZWL$64.75 billion from ZWL$5.1 billion in 2022.

In the group’s insurance cluster, ZB Reinsurance earned a profit after tax of ZWL$43.5 billion from ZWL$4.9 billion in 2022. ZB Life Assurance posted a profit after tax of ZWL$66.6 billion compared to ZWL$6.3 billion in 2022. The group’s Botswana operations contributed 15% to ZB Reinsurance’s Gross Written Premiums.

Overall, the group reported that all of its segments aside from ZB Building Society met their regulatory minimum capital requirements. The group maintains a strong liquidity margin of safety, with the ratio of liquid assets to customer deposits at 55% against the minimum prescribed ratio of 30%.

According to the group, ZB Building Society is currently under a consolidation process with ZB Bank and Intermarket Banking Corporation.

In the boardroom, Mrs. P. Chiromo and Mr. J. Mutevedzi retired from the board with effect from 30 June 2023. Mr. L. Zembe has been appointed as the ZBFH Acting Board Chairman.

The board declared an interim dividend of ZWL 488.47 cents and USD0.0001 cents per share.

Going forward the group will continue to consolidate on its “one stop shop” service centers and its digitization journey.

Commentary and Analysis

Exchange related gains are a significant factor to the group’s financial performance. However, the growth in the group’s core operating revenues is positive, with an aggregate increase of 252% against a 315% increase in operating expenses. The operating expense to core income ratio moderately worsened from 140% to 166%, which compares relatively well against peer banking groups. The group also had the smallest contraction in total deposits among its peers, suggesting a comparatively large share of its business is in hard currency. All this paints a relatively upbeat picture for the group, and a bit of a turnaround story following some behind the scenes changes. With a refortified balance sheet and relatively low gearing, the group looks poised for growth. So, it would be ideal to have a view of the long-term strategic plan for the ZB group within the CBZ Holdings group. Maybe the resolution of the shareholder dispute surrounding ZB Building Society will allow for a clearer picture to develop. In the meantime, the focus for ZB seems to be on expanding consumer facing non-banking services under the “one stop shop” model. This would be a useful diversification away from the reliance on the corporate banking business, and it would leverage the groups large physical branch network. It’s a strategy that could pay off in the long-term, but in the immediate, the group will be expected to leverage its balance sheet to mobilize hard currency resources to support its corporate banking operations. This should see the group offer resilient and steady financial performance in the short-term.

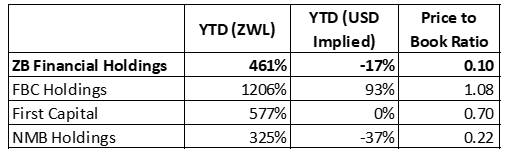

On the ZSE, since the start of 2023 the ZB Financial Holdings share has gained 461% in nominal terms and shed 17% in USD implied terms. The share is trading at a Price to Book ratio of 0.1x – Harare

Advertisement