…as Organizational Transformation Takes Shape

By ETimes

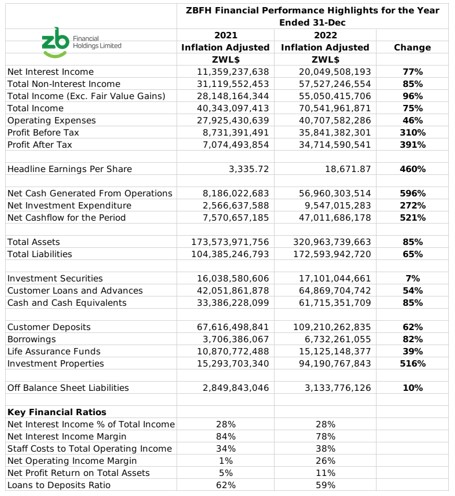

Financial Performance Highlights

- ZSE listed financial services group ZBFH reported a ZWL$34.7 billion inflation adjusted profit after tax for its financial year ended 31 December 2022. The performance was a 391% rise from the previous year, with bargain gains from the acquisition of Mashonaland Holdings and fair value gains contributing ZWL$8.3 billion and ZWL$15.5 billion respectively.

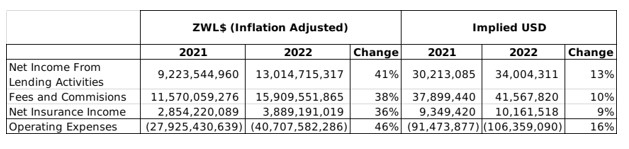

- The groups total income grew by 75% to ZWL$70.5 billion. Net interest income increased by 77% to ZWL$20 billion underpinned by growth in the loan book. Non-interest income increased by 85% to ZWL$57.5 billion, with fees and commissions rising by 38% to ZWL$15.9 billion as the group reported growth in customers and transaction volumes. The banking units, ZB Bank and ZB Building Society posted after tax profits of ZWL$14.5 billion and ZWL$4.5 billion.

- Net insurance related income increased by 36% to ZWL$3.9 billion, as gross premiums increased by 120% to ZWL$15 billion while insurance related expenses increased by 181% to ZWL$11.1 billion. The groups ZB Reinsurance and ZB Life Assurance businesses recorded after tax profits of ZWL$1.95 billion and ZWL$2.3 billion.

- Other operating income increased by 394% to ZWL$22.2 billion driven by realized forex gains from treasury trading activities and unrealized monetary gains from the groups forex denominated balances.

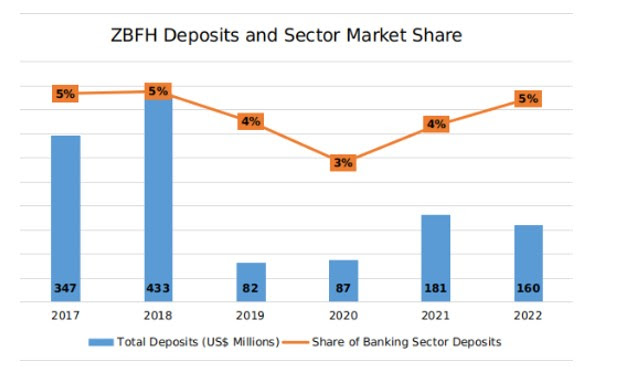

- The groups total deposits increased by 62% to ZWL$109.2 billion. The sector distribution of the deposits remained relatively unchanged, with services accounting for 44%, private individuals 17% and financial institutions 12%.

- Total loans and advances increased by 54% to ZWL$64.9 billion. The sector distribution of the loan book changed moderately, with private loans declining from 44% to 25%, and mining increasing from 3% to 14%.

- Operating expenses increased by 46% to ZWL$40.7 billion, driven largely by inflation. Net cash flows generated from operations increased by 596% to ZWL$56.96 billion

- The groups total assets increased by 85% to ZWL$320.96 billion, while the total liabilities rose by 65% to ZWL$172.59. Off balance sheet liabilities stood at ZWL$3.1 billion.

- Updating on its organizational transformation programme, the group restructured its operations into three main clusters of Banking, Investments and Insurance. The following appointments were made for the Chief Executive Officers of the Clusters: Elisha Chibvuri – Banking Cluster; Tandiwe Masunda – Investments Cluster; and Letwin Mawire – Insurance Cluster. The group also undertook to convert its bank branches to customer service centers, with 25 converted during the 2022 financial and a further 20 planned in 2023.

- Looking ahead the group noted that all of its operations aside from ZB Building Society met their regulatory minimum capital requirements. The group plans to integrate all of its banking operations (ZB Bank, ZB Building Society and Intermarket Banking Corporation) under a single licence. The group also noted its strategic aims to improve revenues, contain operating costs and continue its transformation programme. The group expects to adopt solar energy for all of its operations by the end of 2023.

- The group declared a final dividend of ZWLc837.49, bringing the aggregate dividend for the year to ZWLc914.67.

Commentary and Analysis

Its a performance driven in large part by forex trading income, fair value and monetary gains, and the gains of ZWL$30 bln from the bargain purchase of Mash Holdings. Positively, the groups more conventional income streams saw moderate real growth – although growth in operating expenses was moderately higher (see table above). The full integration of Mash Holdings into the group structure will be expected to boost earnings going forward. It will be interesting to see if the group can unlock long-term value in its newly acquired subsidiary as promised. On paper, it looks like a solid acquisition – a virtual cash cow with a significant USD income and a sizeable land bank for prime property developments.

A concern is that growth in the groups banking business has been fairly subdued, with market share of industry deposits hovering around 5% for the last 5 years. Having been acquired by the CBZ group, the long-term future of ZB’s banking operations is a point of intrigue. The conversion of the branch network to service centers could point to the ultimate strategic role of the ZB group operations in the CBZ group structure that will eventually emerge. On the other hand, it also makes sense as a strategy to leverage the retail focused banking business to draw more business to the groups extended financial services. Ultimately though, it is fair to argue that the group is being reshaped to meet a broader set of objectives. So, overall, the FY23 outlook for ZBFH is neutral – with profits expected to decline without the once-off bargain gains. The profits attained in FY23 are expected to be driven by forex trading income, monetary and fair value gains. Core revenue growth is expected to be moderate while operating cost efficiency should improve: from the transition to solar energy; through synergies from the service center format; and the reduction of staff retrenchment costs from the recent organizational shakeup.

On the ZSE, since the start of 2023, the ZBFH share has lost 6% in nominal terms and 49% in implied USD terms. The share is currently trading at a Price to Book ratio of 0.1x – Harare

Place your advert at affordable rates