By ETimes

Financial Performance Highlights

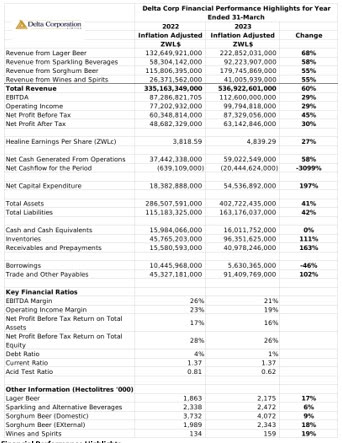

- Listed beverages manufacturer Delta Corporation reported a 30% inflation adjusted rise in net profits after tax to ZWL$63.1 billion for its financial year ended 31 March 2023.

- Operating Income and EBITDA increased by 29% to ZWL$99.8 billion and ZWL$112.6 billion respectively. EBIT was estimated at US$140.6 million.

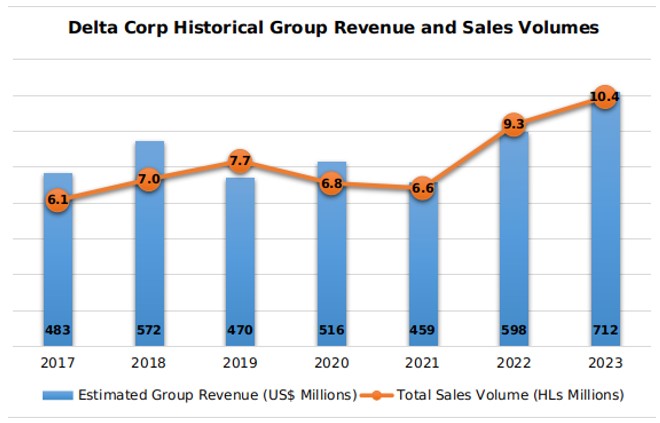

- Total revenues climbed 60% to ZWL$536.9 billion, which was attributed to volume growth across the groups segments and replacement cost pricing. The group estimated its revenue at US$712 million, rising by 19% from the previous year.

- Revenue from the lager beers segment showed the sharpest growth at 68% to ZWL$222.9 billion following sales volume growth of 17% to 2.175 million hectolitres – setting a new all time high for the group. The operation benefited from an injection of returnable glass bottles and improved plant performance. However, packaging capacity remains limited, although the group noted that supplies are improving. The installation of a new packaging plant is on course and expected to be completed by June 2023. Net operating income from the segment stood at ZWL$37.1 billion which was a 53% rise.

- Revenue from the sparkling beverages segment rose by 58% to ZWL$92.2 billion following sales volume growth of 6% to 2.5 million hectolitres. The growth was supported by increased availability returnable glass packs. Supply disruptions arising from power and water shortages were noted. The group expects to commission a new plant in May 2023 to improve the supply of PET packs varieties. Net operating income from the segment increased by 35% to ZWL$9.9 billion.

- Revenue from the sorghum beer segment was up 55% to ZWL$179.7 billion after local sales volumes grew by 9% to 4 million hectolitres and external sales grow by 18% to 2.3 million hectolitres. A new plant is being installed at the Harare Brewery which is expected to be commissioned by June 2023. Chibuku Super was introduced to the South Africa market as The United National Breweries SA operation saw a 12% rise in volumes. Volume growth in the market was dampened by price distortions created by a lack of pricing compliance by traders due to rising fuel and distribution costs. The Butterworths brewery in the Eastern Cape was reopened to improve supply and ease distribution costs. NatBrew Zambia reported 28% volume growth, with efforts to stabilize the supply and revamp distribution channels targeted for the new year – although concerns were noted about maize supply challenges and rising import costs due to currency depreciation. Net operating income from the segment marginally declined by 3% to ZWL$18.9 billion.

- The wine and spirits segment saw revenue growth of 55% to ZWL$41 billion as volumes increased 19% to 159,000 hectolitres. The growth was driven by ciders, which grew by 23% while wines grew by 16%. The group attributed the volume growth to improved availability of local brands and more direct distribution channels to distributors. A new PET line was commissioned and the fermentation of ciders was localized during the year.

- At the groups Schweppes Holdings associate company, volumes were flat as shortages of juice concentrates and plant breakdowns restricted supply while pricing distortions disrupted supplies to formal outlets. Volumes at the Nampak associate were steady, and the operation is focused on stabilizing supply of key imported raw materials.

- Net cash generated by operations increased by 58% to ZWL$59 billion and total net capital expenditure stood at ZWL$54 billion as the group invested heavily in capacity maintenance and expansion. Repayment of outstanding borrowings contributed to a negative net cash flow of ZWL$20.4 billion.

- Total assets stood at ZWL$402.7 billion, with cash holdings of ZWL$16 billion, inventories of ZWL$96.4 billion and receivables of ZWL$41 billion. Total liabilities stood at ZWL$163.2 billion, with total borrowings of ZWL$5.6 billion and borrowings of ZWL$91.4 billion.

- Looking ahead, the group painted a neutral outlook, expecting increased agricultural production and election spending to stimulate aggregate demand whilst also noting the trend towards dollarization and the economic contraction that may arise from it. The group also noted the volatile global environment, and the economic challenges facing Zambia and South Africa. The group outlined its strategy to leverage its capacity investments and exploit emerging opportunities.

- The group declared a dividend of USc 2 to be paid on 21 June 2023.

Commentary and Analysis

Its a fair set of results for the group, with decent growth in revenues and sales volumes. Analysis puts the USD estimate of the FY23 revenue and total sales volumes at 7 year highs. The group successfully defended its market shares in key segments – notably increasing its share of the sorghum beer market to 92% despite the emergence of competition from Innscor’s Buffalo Brewing Company. The decline in operating income and EBITDA margins is expected with the power supply shortages and rising input prices. The negative net cash flows are mitigated by the group investing significantly in capacity and working capital, and reducing outstanding debts in the high interest rate environment. Additionally, the group still maintains a relatively healthy cash position. The increased distribution channels to the hard currency paying informal markets coincided with noticeably more stable product availability. The increased domestic agricultural production should ease some raw material supply challenges. The major downside risk for the group is the prospect of increased pricing distortions in the formal markets as exchange volatility increases and authorities look to suppress inflation. This is mitigated somewhat by the aforementioned informal market distribution channels, but sales would still be expected to take a material hit – it would be interesting to know the exact split between USD and ZWL sales. So, overall, the outlook for Delta Corp is stable, with ample working capital to meet support production and the resilience of the groups sales likely to hold against the volatile consumer environment. Although, the groups margins are expected to remain under pressure as the local and regional operating environments remain challenging.

On the ZSE, since the start of 2023, the Delta share has gained 393% in nominal terms and 140% in implied USD terms. The share is currently trading at a Price to Book ratio of 4.7x – Harare

Place your advert at affordable rate