By ETimes

Financial Performance Highlights

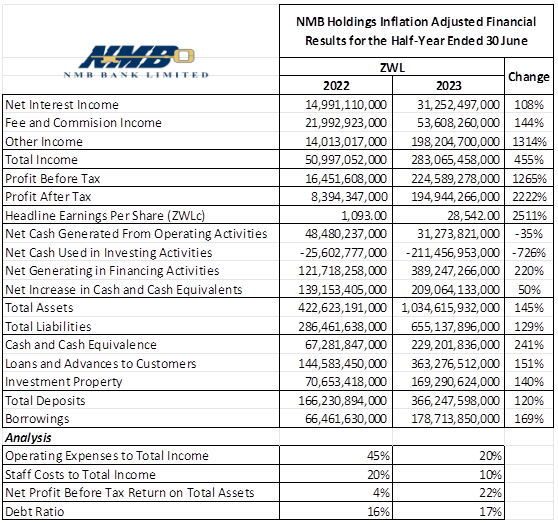

- ZSE listed financial services group NMB Holdings saw its after-tax profits rise by 2222% to ZWL$194.9 billion in its half-year ended 30 June 2023.

- The performance was largely driven by non-core income with net foreign exchange gains of ZWL$97.7 billion and fair value gains on investment properties of ZWL$98.7 billion.

- Net interest income grew by 108% to ZWL$31.3 billion. Fees and commissions increased by 144% to ZWL$53.61 billion with the group highlighting its efforts to enhance revenues through its digital banking platforms which contributed ZWL$17.1 billion. The group also highlighted the launch of its Gadziro funeral cover products as well as growth in its exporters book. The group expects to roll out a number of partnerships in the “Agriculture space” during the second half of 2023.

- The group’s operations generated ZWL$31.2 billion in net cash, and invested ZWL$220.8 billion in investment securities during the year. The group raised financing to cover the deficit which saw an overall increase of ZWL$209 billion to the groups cash position.

- Total assets increased by 145% to ZWL$1 trillion, with cash holdings making up ZWL$229 billion and investment properties ZWL$169.3 billion. Loans and advances contributed ZWL$363 billion after a 151% rise, while the non-performing loans ratio improved to 0.57% from 1.09%. The group’s loan book is made up of loans to agriculture (23%), distribution (21%), manufacturing (20%) and services (20%).

- Total liabilities increased by 129% to ZWL$655 billion, with deposits accounting for ZWL$366 billion and borrowings ZWL$178.7 billion. The majority of the group’s customer deposits were from customers in the services sector.

- The group reported that its NMB Bank segment is adequately capitalized with a total capital adequacy ratio of 27.79%. The bank is in discussions with various lenders and expects to begin draw-downs on the facilities in the third quarter of 2023.

- The group also reported the launch of a new segment named X Plug Solutions which aims to provide digital transformation solutions such as mobile apps, USSD, Internet banking solutions, digital customer on-boarding, agency banking, workflow, Robotics Processes Automation (RPA) solutions and cybersecurity management tools. The unit is targeting financial and non-financial organizations both locally and regionally.

- The recently established NMB Properties segment reportedly has a number of projects in the pipeline.

- Going forward, the group will look to ensure the growth of its newly formed subsidiaries and target value preservation.

- In the boardroom, Mr. P. Gowero was appointed to the Board with effect from 26 April 2023.

- The board declared an interim dividend of ZWL556 cents per share.

Commentary and Analysis

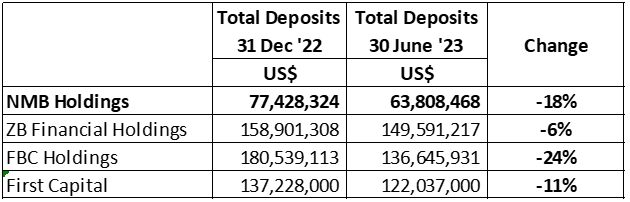

The increasing consolidation in the banking sector raises a lot of questions for the “middle of the pack” players like NMB. The group has a longstanding name and reputable brand within the sector but, the space for growth is rapidly shrinking and it has a relatively weak balance sheet. The launch of NMB Properties has a late to the party feel about it. Conversely, the move into the fintech space with the X-Plug Solutions business unit feels fresh and innovative. It is an area that holds a lot of potential both locally and regionally but it is also fiercely competitive. The new units’ regional ambitions will practically require it to be globally competitive, which will be a tall order. On the plus side, the group has the best operating expenses to core income ratio among its peers at 65%. A decent part of that is likely due to the group’s comparatively lean scale of operations, but it still lends some support to the strategic focus on tech and digitization. It could be a platform for NMB to sell itself as an innovative tech-driven operation, and establish a resilient niche market in the banking/financial services sector. However, the group’s weak balance sheet is likely to be a significant limiting factor. So overall, the short-term outlook for NMB Holdings is stable based on the group’s cost efficiency, although the increased dollarization might have some downside for its key income line. The long-term outlook is more subdued, with a sense that the group needs to raise capital.

On the ZSE, since the start of 2023 the NMB Holdings share has gained 325% in nominal terms and lost 37% in implied USD terms. The share is currently trading at a Price to Book ratio of 0.22x – Harare

Advertisement